-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

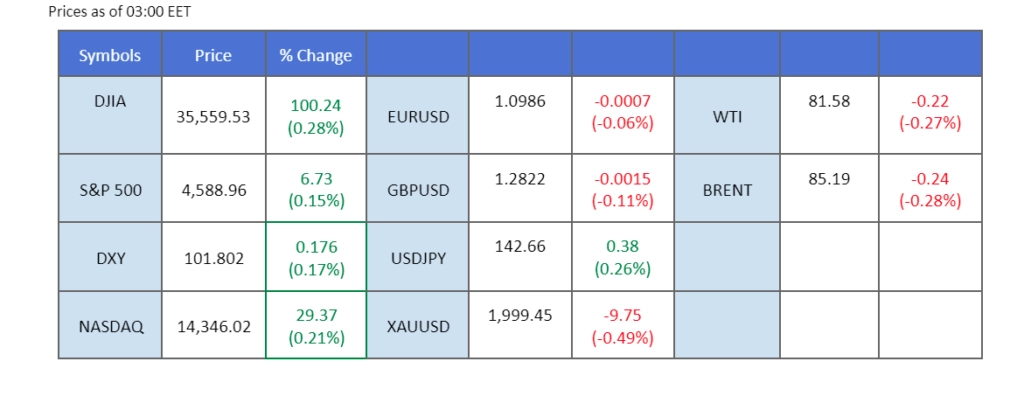

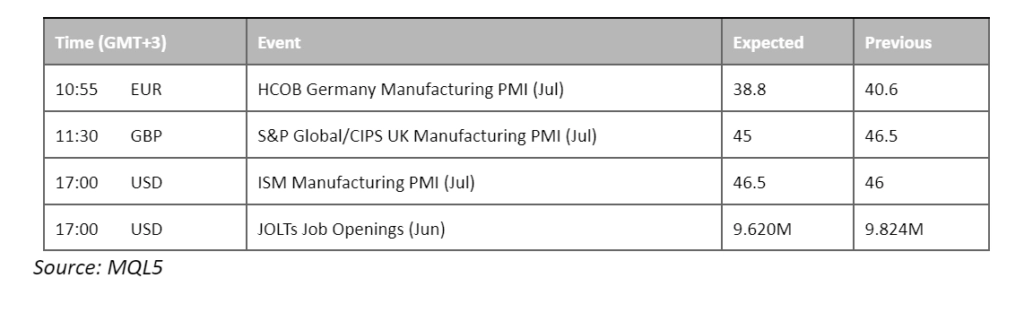

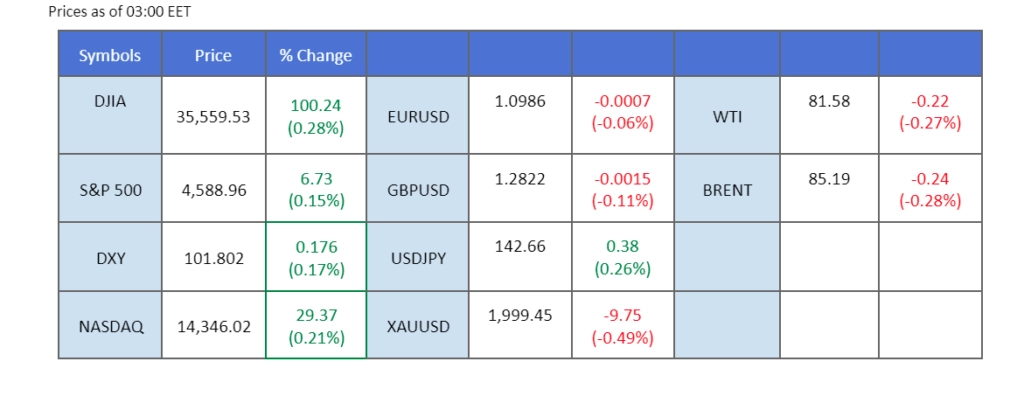

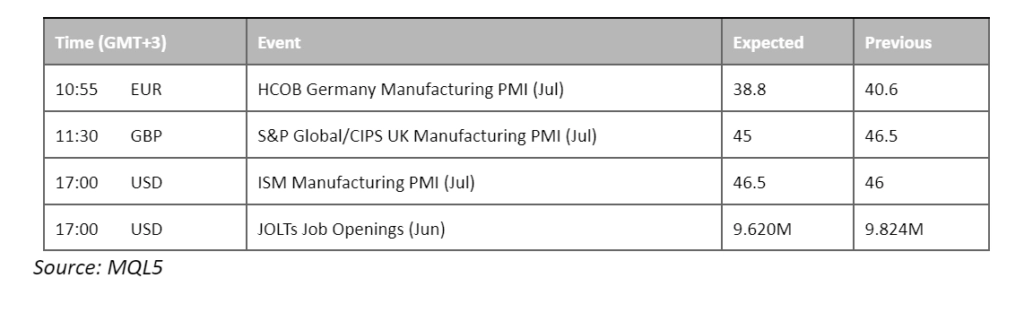

All eyes are on the Reserve Bank of Australia (RBA) as investors eagerly await the announcement of their interest rate decision, scheduled for later today. Market analysts have projected a 25 basis point rate hike from the Australian central bank. However, recent CPI and PPI data reveal a slowdown in inflation within the Oceanian country, potentially providing grounds for the RBA to consider a rate hike pause in this round. Across the Asian regional equity markets, a positive tone prevails as they opened higher this morning. This upward trend is attributed to the Chinese economic stimulus package and the Bank of Japan’s consistent adherence to its ultra-loose monetary policy. Meanwhile, the oil market has significantly surged, with prices soaring by 16% in July. This notable monthly gain marks the largest increase since early 2022.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar showed muted movement with a slight uptick, as investors engaged in a technical correction while maintaining confidence in the US economy. Bargain buying contributed to the dollar’s marginal gains. Investors are advised to continue monitoring further US economic data for further trading signals.

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the index might extend its gains as the RSI continues to stay above the midline.

Resistance level: 101.95, 104.80

Support level: 99.05, 94.95

With economists projecting a smaller-than-expected increase in US Nonfarm Payroll data, concerns over a potential slowdown in the red-hot labour market have surfaced. This has driven investors towards safe-haven asset gold, seeking protection amidst uncertainties. The mounting worries over the potential slowdown in the robust labour market ahead of the US Nonfarm Payroll report have sparked a shift in sentiment towards safe-haven assets, driving investors towards gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1970.00, 1985.00

Support level: 1945.00, 1930.00

The Eurozone’s Consumer Price Index (CPI) and Gross Domestic Product (GDP) data have been reported slightly higher than market expectations. However, this seemingly positive economic data has failed to provide the necessary impetus for the euro to trade stronger against its currency peers. Adding to the concerns, German Retail Sales experienced a significant decline, dropping from 1.9% to -0.8% compared to its previous reading. This downturn in retail sales indicates that the Eurozone’s economy is not adequately supporting the European Central Bank’s (ECB) efforts to implement a more hawkish monetary policy.

EUR/USD is trading in a bearish momentum and has come to a crucial support level at around 1.0960. The RSI has been hovering below the 50-level while the MACD flows flat below the zero line suggesting the bearish momentum is still intact with the pair.

Resistance level: 1.1092, 1.1150

Support level: 1.0927, 1.0845

The Australian Dollar (AUD) is on an upward trajectory as positive Chinese stimulus measures continue to boost confidence in the currency as a Chinese proxy. Optimism towards China’s economic progress, driven by the stimulus plan aimed at boosting domestic consumption and reviving growth, has also positively impacted other China proxy currencies like the Aussie Dollar.

The Aussie dollar is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the pair might experience technical correction since the RSI below the midline.

Resistance level: 0.6725, 0.6815

Support level: 0.6625, 0.6545

The British Pound is experiencing a lack of clear direction as it approaches the Bank of England’s (BoE) interest rate decision announcement scheduled for Thursday. Despite the UK having relatively high inflation when compared to its peers, the Sterling is struggling to gain traction in the markets. One of the key factors contributing to Sterling’s challenges is the deepening concerns over a potential recession. These fears have arisen due to the BoE’s previous aggressive tightening policy. The central bank faces a dilemma as it weighs the decision to either continue raising interest rates to combat inflationary pressures or prioritise safeguarding the economy from slipping into a recession.

Sterling continues to trade in a bearish momentum and a trend reversal signal is yet to form. The RSI continued to flow below the 50-level while the MACD failed to break above the zero line suggesting the pair is still trading with a bearish momentum.

Resistance level: 1.2888, 1.3020

Support level: 1.2760, 1.2655

The US equity market wrapped up July on a positive note, posting a second consecutive month of gains. Notably, energy stocks took the lead, supported by a more than 3% surge in Chevron, which received a boost after Goldman Sachs upgraded the company, citing strong growth potential. Climbing oil prices, fueled by bets of tightening global supply and rising demand, further added to the market’s bullish sentiment.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 35605.50, 36520.00

Support level: 34550.00, 33715.00

Oil prices continued their ascent, hitting a three-month high, as investor concerns mounted over tight crude supplies during the summer. Expectations of an agreement on oil production cuts during the OPEC+ group’s Joint Ministerial Monitoring Committee meeting contributed to the positive outlook, boosting market optimism for oil stability. On the other hand, oil prices were further boosted by the latest Chinese stimulus plan, as investors anticipate its potential to enhance economic momentum and drive up oil demand.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 83.20, 86.10

Support level: 80.55, 77.30

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

All eyes are on the Reserve Bank of Australia (RBA) as investors eagerly await the announcement of their interest rate decision, scheduled for later today. Market analysts have projected a 25 basis point rate hike from the Australian central bank. However, recent CPI and PPI data reveal a slowdown in inflation within the Oceanian country, potentially providing grounds for the RBA to consider a rate hike pause in this round. Across the Asian regional equity markets, a positive tone prevails as they opened higher this morning. This upward trend is attributed to the Chinese economic stimulus package and the Bank of Japan’s consistent adherence to its ultra-loose monetary policy. Meanwhile, the oil market has significantly surged, with prices soaring by 16% in July. This notable monthly gain marks the largest increase since early 2022.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar showed muted movement with a slight uptick, as investors engaged in a technical correction while maintaining confidence in the US economy. Bargain buying contributed to the dollar’s marginal gains. Investors are advised to continue monitoring further US economic data for further trading signals.

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the index might extend its gains as the RSI continues to stay above the midline.

Resistance level: 101.95, 104.80

Support level: 99.05, 94.95

With economists projecting a smaller-than-expected increase in US Nonfarm Payroll data, concerns over a potential slowdown in the red-hot labour market have surfaced. This has driven investors towards safe-haven asset gold, seeking protection amidst uncertainties. The mounting worries over the potential slowdown in the robust labour market ahead of the US Nonfarm Payroll report have sparked a shift in sentiment towards safe-haven assets, driving investors towards gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1970.00, 1985.00

Support level: 1945.00, 1930.00

The Eurozone’s Consumer Price Index (CPI) and Gross Domestic Product (GDP) data have been reported slightly higher than market expectations. However, this seemingly positive economic data has failed to provide the necessary impetus for the euro to trade stronger against its currency peers. Adding to the concerns, German Retail Sales experienced a significant decline, dropping from 1.9% to -0.8% compared to its previous reading. This downturn in retail sales indicates that the Eurozone’s economy is not adequately supporting the European Central Bank’s (ECB) efforts to implement a more hawkish monetary policy.

EUR/USD is trading in a bearish momentum and has come to a crucial support level at around 1.0960. The RSI has been hovering below the 50-level while the MACD flows flat below the zero line suggesting the bearish momentum is still intact with the pair.

Resistance level: 1.1092, 1.1150

Support level: 1.0927, 1.0845

The Australian Dollar (AUD) is on an upward trajectory as positive Chinese stimulus measures continue to boost confidence in the currency as a Chinese proxy. Optimism towards China’s economic progress, driven by the stimulus plan aimed at boosting domestic consumption and reviving growth, has also positively impacted other China proxy currencies like the Aussie Dollar.

The Aussie dollar is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the pair might experience technical correction since the RSI below the midline.

Resistance level: 0.6725, 0.6815

Support level: 0.6625, 0.6545

The British Pound is experiencing a lack of clear direction as it approaches the Bank of England’s (BoE) interest rate decision announcement scheduled for Thursday. Despite the UK having relatively high inflation when compared to its peers, the Sterling is struggling to gain traction in the markets. One of the key factors contributing to Sterling’s challenges is the deepening concerns over a potential recession. These fears have arisen due to the BoE’s previous aggressive tightening policy. The central bank faces a dilemma as it weighs the decision to either continue raising interest rates to combat inflationary pressures or prioritise safeguarding the economy from slipping into a recession.

Sterling continues to trade in a bearish momentum and a trend reversal signal is yet to form. The RSI continued to flow below the 50-level while the MACD failed to break above the zero line suggesting the pair is still trading with a bearish momentum.

Resistance level: 1.2888, 1.3020

Support level: 1.2760, 1.2655

The US equity market wrapped up July on a positive note, posting a second consecutive month of gains. Notably, energy stocks took the lead, supported by a more than 3% surge in Chevron, which received a boost after Goldman Sachs upgraded the company, citing strong growth potential. Climbing oil prices, fueled by bets of tightening global supply and rising demand, further added to the market’s bullish sentiment.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 35605.50, 36520.00

Support level: 34550.00, 33715.00

Oil prices continued their ascent, hitting a three-month high, as investor concerns mounted over tight crude supplies during the summer. Expectations of an agreement on oil production cuts during the OPEC+ group’s Joint Ministerial Monitoring Committee meeting contributed to the positive outlook, boosting market optimism for oil stability. On the other hand, oil prices were further boosted by the latest Chinese stimulus plan, as investors anticipate its potential to enhance economic momentum and drive up oil demand.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 83.20, 86.10

Support level: 80.55, 77.30

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.