-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

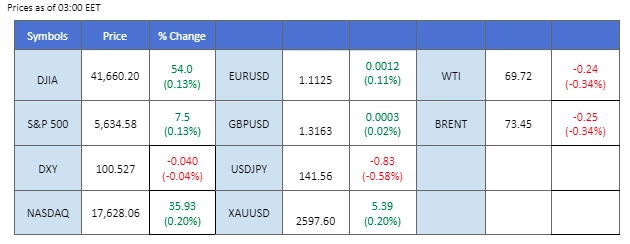

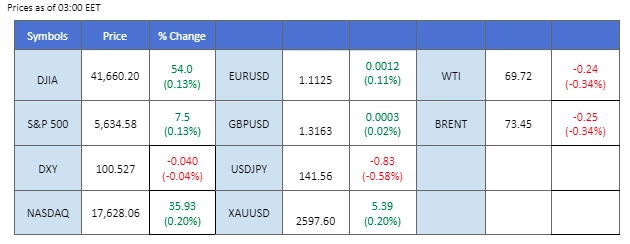

Market Summary

The financial spotlight today is on the FOMC interest rate decision and Jerome Powell’s speech, both highly anticipated by global markets. The futures and bond markets are positioning for a larger-than-usual rate cut, exceeding the standard 25 bps. As speculation of this larger cut grows, the U.S. dollar has continued to weaken, while Wall Street held steady last night in anticipation of the economic event.

In contrast, the Japanese stock market rose as the yen weakened, following disappointing Japanese trade data. Both the dollar and the euro gained over 1% against the yen in the last session.

In commodities, gold remains close to its all-time high. Should the Fed’s decision align with market expectations, gold could potentially record new highs. On the other hand, oil prices are losing momentum, with WTI crude facing rejection at the key $70 resistance level. Oil traders are closely watching the Fed decision, as a dovish monetary policy could boost oil prices further.

In the crypto market, Bitcoin (BTC) has surged by over 10% since last Monday, trading above the $60,000 mark. Optimism surrounding the Fed’s rate cut has fueled this rally, and if the decision favours the crypto market, BTC’s bullish momentum could continue.

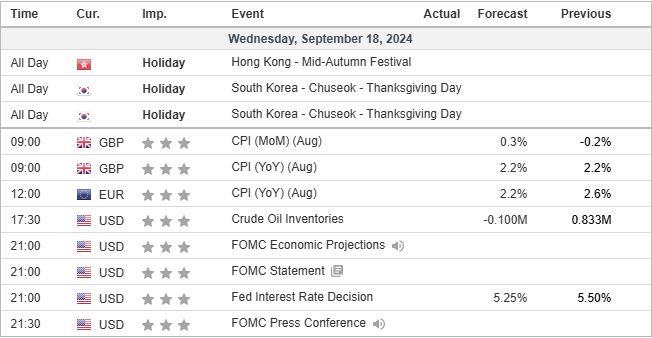

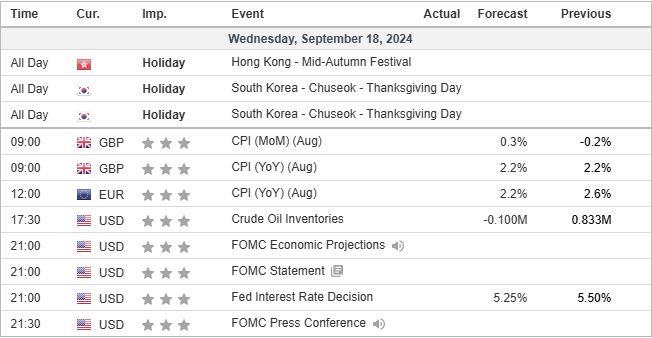

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (52%) VS -25 bps (48%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the greenback against a basket of six major currencies, remains steady, despite stronger-than-expected US retail sales data. According to the Commerce Department, retail sales rose 0.10% against a forecasted -0.20%, offering positive signs for consumer activity. However, all eyes are now on the Federal Reserve’s upcoming interest rate decision. The Fed’s Federal Open Market Committee (FOMC) is set to announce its decision on Wednesday, followed by a press conference by Chair Jerome Powell. Currently, Fed funds futures are pricing in a 63% chance of a 50-basis point rate cut, a sharp increase from 30% just a week ago.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 101.80, 102.35

Support level: 100.55, 99.70

Gold remains resilient near record highs, driven by dovish expectations from the Fed and heightened market volatility in the lead-up to the U.S. election. Recent technical retracement has been attributed to profit-taking, but the underlying bullish sentiment for gold remains intact as traders anticipate potential rate cuts and geopolitical risks. Investors should continue to monitor key monetary policy decisions to gauge the direction of gold prices in the near term.

Gold prices are trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2585.00, 2605.00

Support level: 2560.00, 2540.00

Pound Sterling continues to face uncertainty ahead of the Bank of England’s (BoE) rate decision on Thursday. Investors are treading cautiously, particularly as the UK Consumer Price Index (CPI) report looms. The BoE is expected to hold rates at 5%, with markets pricing in a 36% chance of another rate cut. Traders are closely watching CPI figures to determine the Pound’s trajectory, as inflation data could swing market expectations either toward stability or further easing.

GBP/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 1.3215, 1.3280

Support level:1.3105, 1.3025

The EUR/USD pair has formed a higher-high price pattern, signalling a bullish bias after breaking above its downtrend resistance level. This upward movement has been primarily driven by the weakened U.S. dollar, with the pair recording gains over the past week. Looking ahead, euro traders are closely watching the upcoming Eurozone CPI data, which is expected to show a further easing in inflationary pressures. Should the data confirm this expectation, it could weigh on the euro’s strength, potentially moderating the pair’s upward momentum. However, the overall trend currently favours a bullish outlook as long as the dollar remains weak.

EUR/USD is trading with strong bullish momentum and is supported at the 1.1105 level. The RSI is hovering close to the overbought zone, while the MACD continues to edge higher, suggesting that the pair’s bullish momentum remains strong.

Resistance level: 1.1170, 1.1228

Support level: 1.1105, 1.0985

The Japanese stock market has stabilised, easing from its recent downtrend and now consolidating within the 35,300 to 36,850 range, indicating a potential trend reversal for the Nikkei index. This consolidation phase suggests that the market may be positioning for an upward move, particularly given the easing strength of the Japanese yen. The yen’s decline followed the release of disappointing trade data from Japan, which came in below expectations. The weakening of the yen has provided support for the Nikkei’s upward momentum.

Nikkei is currently resisted at the near 36850 level; a break above this level may be seen as a bullish signal for the index. The RSI is gradually gaining, while the MACD has a bullish cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 36850.00, 37950.00

Support level: 35300.00, 33740.00

The Japanese Yen continues to gain appeal as traders anticipate that the Bank of Japan (BoJ) may hold rates steady, bolstering the Yen against the Dollar. Though the BoJ is expected to maintain its policy on Friday, there are hints that further rate hikes could be on the horizon, potentially making the upcoming October meeting a critical turning point. This has driven demand for the Yen as a safe-haven currency in comparison to the U.S. Dollar, which faces uncertainties around the Fed’s policy direction.

USD/JPY is trading lower while currently near the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 37, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 144.00, 147.10

Support level: 140.20, 133.95

Crude oil prices have surged, supported by supply concerns in the US Gulf of Mexico. Over 12% of crude production remains offline in the aftermath of Hurricane Francine, helping lift oil prices from near three-year lows. Additionally, geopolitical tensions in the Middle East have escalated. Hezbollah vowed retaliation against Israel after a series of blasts in Lebanon on Tuesday, leading to further fears of supply disruptions. Meanwhile, talks mediated by the United Nations to resolve the ongoing crisis in Libya have yet to yield results. Oil output in Libya has been reduced, with exports in September falling by over 50% from the previous month, adding another layer of supply strain to global oil markets.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 70.00, 71.95

Support level: 67.55, 65.60

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The financial spotlight today is on the FOMC interest rate decision and Jerome Powell’s speech, both highly anticipated by global markets. The futures and bond markets are positioning for a larger-than-usual rate cut, exceeding the standard 25 bps. As speculation of this larger cut grows, the U.S. dollar has continued to weaken, while Wall Street held steady last night in anticipation of the economic event.

In contrast, the Japanese stock market rose as the yen weakened, following disappointing Japanese trade data. Both the dollar and the euro gained over 1% against the yen in the last session.

In commodities, gold remains close to its all-time high. Should the Fed’s decision align with market expectations, gold could potentially record new highs. On the other hand, oil prices are losing momentum, with WTI crude facing rejection at the key $70 resistance level. Oil traders are closely watching the Fed decision, as a dovish monetary policy could boost oil prices further.

In the crypto market, Bitcoin (BTC) has surged by over 10% since last Monday, trading above the $60,000 mark. Optimism surrounding the Fed’s rate cut has fueled this rally, and if the decision favours the crypto market, BTC’s bullish momentum could continue.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (52%) VS -25 bps (48%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the greenback against a basket of six major currencies, remains steady, despite stronger-than-expected US retail sales data. According to the Commerce Department, retail sales rose 0.10% against a forecasted -0.20%, offering positive signs for consumer activity. However, all eyes are now on the Federal Reserve’s upcoming interest rate decision. The Fed’s Federal Open Market Committee (FOMC) is set to announce its decision on Wednesday, followed by a press conference by Chair Jerome Powell. Currently, Fed funds futures are pricing in a 63% chance of a 50-basis point rate cut, a sharp increase from 30% just a week ago.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 101.80, 102.35

Support level: 100.55, 99.70

Gold remains resilient near record highs, driven by dovish expectations from the Fed and heightened market volatility in the lead-up to the U.S. election. Recent technical retracement has been attributed to profit-taking, but the underlying bullish sentiment for gold remains intact as traders anticipate potential rate cuts and geopolitical risks. Investors should continue to monitor key monetary policy decisions to gauge the direction of gold prices in the near term.

Gold prices are trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2585.00, 2605.00

Support level: 2560.00, 2540.00

Pound Sterling continues to face uncertainty ahead of the Bank of England’s (BoE) rate decision on Thursday. Investors are treading cautiously, particularly as the UK Consumer Price Index (CPI) report looms. The BoE is expected to hold rates at 5%, with markets pricing in a 36% chance of another rate cut. Traders are closely watching CPI figures to determine the Pound’s trajectory, as inflation data could swing market expectations either toward stability or further easing.

GBP/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 1.3215, 1.3280

Support level:1.3105, 1.3025

The EUR/USD pair has formed a higher-high price pattern, signalling a bullish bias after breaking above its downtrend resistance level. This upward movement has been primarily driven by the weakened U.S. dollar, with the pair recording gains over the past week. Looking ahead, euro traders are closely watching the upcoming Eurozone CPI data, which is expected to show a further easing in inflationary pressures. Should the data confirm this expectation, it could weigh on the euro’s strength, potentially moderating the pair’s upward momentum. However, the overall trend currently favours a bullish outlook as long as the dollar remains weak.

EUR/USD is trading with strong bullish momentum and is supported at the 1.1105 level. The RSI is hovering close to the overbought zone, while the MACD continues to edge higher, suggesting that the pair’s bullish momentum remains strong.

Resistance level: 1.1170, 1.1228

Support level: 1.1105, 1.0985

The Japanese stock market has stabilised, easing from its recent downtrend and now consolidating within the 35,300 to 36,850 range, indicating a potential trend reversal for the Nikkei index. This consolidation phase suggests that the market may be positioning for an upward move, particularly given the easing strength of the Japanese yen. The yen’s decline followed the release of disappointing trade data from Japan, which came in below expectations. The weakening of the yen has provided support for the Nikkei’s upward momentum.

Nikkei is currently resisted at the near 36850 level; a break above this level may be seen as a bullish signal for the index. The RSI is gradually gaining, while the MACD has a bullish cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 36850.00, 37950.00

Support level: 35300.00, 33740.00

The Japanese Yen continues to gain appeal as traders anticipate that the Bank of Japan (BoJ) may hold rates steady, bolstering the Yen against the Dollar. Though the BoJ is expected to maintain its policy on Friday, there are hints that further rate hikes could be on the horizon, potentially making the upcoming October meeting a critical turning point. This has driven demand for the Yen as a safe-haven currency in comparison to the U.S. Dollar, which faces uncertainties around the Fed’s policy direction.

USD/JPY is trading lower while currently near the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 37, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 144.00, 147.10

Support level: 140.20, 133.95

Crude oil prices have surged, supported by supply concerns in the US Gulf of Mexico. Over 12% of crude production remains offline in the aftermath of Hurricane Francine, helping lift oil prices from near three-year lows. Additionally, geopolitical tensions in the Middle East have escalated. Hezbollah vowed retaliation against Israel after a series of blasts in Lebanon on Tuesday, leading to further fears of supply disruptions. Meanwhile, talks mediated by the United Nations to resolve the ongoing crisis in Libya have yet to yield results. Oil output in Libya has been reduced, with exports in September falling by over 50% from the previous month, adding another layer of supply strain to global oil markets.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 70.00, 71.95

Support level: 67.55, 65.60

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.