-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

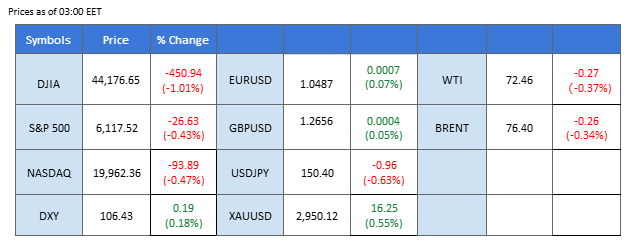

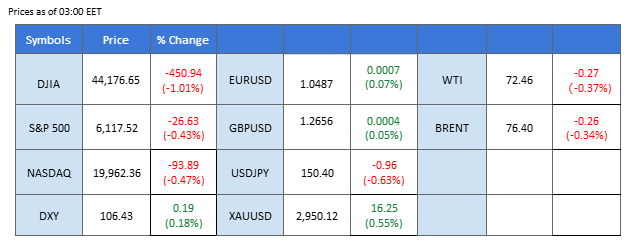

Market Summary

The U.S. dollar extended its losses sharply following disappointing economic data, fueling concerns over slowing economic momentum. Initial jobless claims surged to 219K, missing expectations of 215K, while the Philadelphia Fed Manufacturing Index also came in below forecast at 18.1. The weaker data added to growing pessimism about the U.S. economic outlook, despite Federal Reserve officials maintaining a cautious stance on rate cuts. The uncertainty surrounding Fed policy has further pressured the dollar, intensifying volatility in financial markets.

Gold prices surged as the dollar weakened, benefiting from renewed safe-haven demand. Lingering geopolitical risks, including stalled Russia-Ukraine ceasefire talks, continued to support the precious metal. Additionally, Trump’s aggressive stance on tariffs has reignited trade war fears, further boosting gold as a hedge against economic uncertainty. With multiple risk factors weighing on investor sentiment, gold’s bullish momentum remains intact.

In Asia, the Hang Seng Index (HSI) extended its gains, attempting to break above recent highs amid renewed optimism in China’s tech sector. Investor confidence was bolstered by President Xi Jinping’s engagement with industry leaders and the AI-driven “DeepSeek” rally. Alibaba’s strong earnings further reinforced market sentiment, highlighting Beijing’s supportive policies aimed at stimulating economic growth.

In contrast, U.S. equities struggled, with Walmart’s weaker sales guidance signaling cracks in consumer spending, adding to market concerns.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

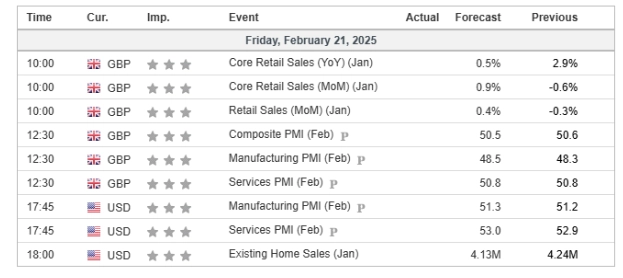

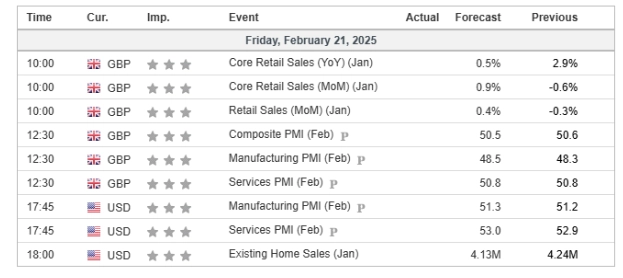

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The U.S. dollar extended its decline to a new low for 2025, with bearish momentum accelerating following the release of Initial Jobless Claims. The weaker-than-expected jobs data has further dented sentiment, reinforcing concerns that the U.S. labor market may be softening. Adding to the pressure, Trump’s renewed tariff threats and the ballooning U.S. national debt have eroded confidence in the greenback, prompting investors to seek alternatives. With market sentiment shifting away from the dollar, further downside pressure may persist unless a stronger economic catalyst emerges.

The Dollar Index has reached a new low and broken below its support level at 106.55, suggesting a bearish bias for the index. The RSI is returning to the oversold zone, while the MACD failed to break above the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 107.35, 108.40

Support level: 105.50, 103.70

Gold prices soared to a fresh all-time high above $2,950, before experiencing a slight pullback, stabilizing above $2,930. The precious metal continues to trade in an extremely bullish manner, fueled by escalating geopolitical tensions and mounting uncertainty over Trump’s tariff threats, which could spark a trade war with key partners. Meanwhile, the U.S. dollar remains subdued, further bolstering gold’s safe-haven appeal. With investors seeking protection amid global economic uncertainty, the yellow metal is poised to extend gains as long as the dollar weakness persists.

Gold prices have recorded new highs while remaining in a higher-high price pattern, suggesting a bullish bias for gold. The momentum indicators, including the RSI and the MACD, have been edging higher, suggesting that bullish momentum is gaining.

Resistance level: 2960.00, 3007.00

Support level: 2918.70, 2875.00

The British Pound extends its gains as resilient UK economic data dampens expectations for aggressive Bank of England (BoE) rate cuts. January’s hotter-than-expected inflation, coupled with accelerating wage growth and unexpected GDP expansion, has led markets to reassess the likelihood of two rate cuts this year. With the BoE meeting set for March 20, investors will closely watch upcoming retail sales and business activity data for further clarity. Persistent economic strength could reinforce a hawkish BoE stance, supporting further Pound appreciation.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 68, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.2720, 1.2800

Support level: 1.2635, 1.2515

The Euro strengthens amid US Dollar weakness but faces structural headwinds from geopolitical uncertainty and sluggish economic momentum. The Russia-Ukraine war continues to weigh on sentiment, exacerbated by reports of US-Russia negotiations that exclude Ukraine and the EU, raising concerns over Europe’s security framework. While the European Central Bank (ECB) maintains a cautious approach to rate cuts, weaker growth prospects relative to peers limit the Euro’s upside. Investors will monitor geopolitical developments and ECB signals for directional cues.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.0515, 1.0595

Support level: 1.0445, 1.0385

The Hang Seng Index (HSI) remains in a strong uptrend, driven by renewed optimism in China’s tech sector following President Xi Jinping’s engagement with industry leaders and the AI-driven “DeepSeek” rally. Alibaba’s earnings beat further bolstered sentiment, reinforcing confidence in Beijing’s supportive policies aimed at reviving economic growth. With strong corporate performance and policy tailwinds, the HSI is poised to sustain its bullish momentum in the near term.

HK50 is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 23240.00, 24915.00

Support level: 21125.00, 19015.00

The Dow Jones faces renewed pressure as weaker consumer sentiment clouds the US economic outlook. Walmart’s disappointing sales guidance signals potential cracks in consumer spending, while Federal Reserve officials continue to advocate a cautious stance on rate cuts. With inflation still above target and monetary policy expected to remain restrictive, equity markets may face heightened volatility, with investors closely tracking economic data and Fed commentary for further direction.

Dow Jones is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 44300.00, 45050.00

Support level: 43370.00, 41865.00

Crude oil prices continued to edge higher, defying weaker-than-expected U.S. crude inventory data. Market participants shifted their focus to heightened geopolitical risks, as escalating crossfire between Ukraine and Russia saw both sides targeting oil and gas facilities, fueling supply disruption concerns. However, potential diplomatic progress between the U.S. and Russia, following recent peace talks, could ease geopolitical tensions. If the U.S. reconsiders its sanctions on Russian oil, the market could see downward pressure on crude prices. Traders remain cautious, weighing supply risks against potential policy shifts.

Crude prices seemingly found support at the 70.40 mark, with a triple bottom formed at this level, and are edging higher. The RSI has been gaming, while the MACD has broken above the zero line, suggesting that the bullish momentum is gaining with oil prices.

Resistance level: 73.30, 75.25

Support level: 71.80, 70.40

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The U.S. dollar extended its losses sharply following disappointing economic data, fueling concerns over slowing economic momentum. Initial jobless claims surged to 219K, missing expectations of 215K, while the Philadelphia Fed Manufacturing Index also came in below forecast at 18.1. The weaker data added to growing pessimism about the U.S. economic outlook, despite Federal Reserve officials maintaining a cautious stance on rate cuts. The uncertainty surrounding Fed policy has further pressured the dollar, intensifying volatility in financial markets.

Gold prices surged as the dollar weakened, benefiting from renewed safe-haven demand. Lingering geopolitical risks, including stalled Russia-Ukraine ceasefire talks, continued to support the precious metal. Additionally, Trump’s aggressive stance on tariffs has reignited trade war fears, further boosting gold as a hedge against economic uncertainty. With multiple risk factors weighing on investor sentiment, gold’s bullish momentum remains intact.

In Asia, the Hang Seng Index (HSI) extended its gains, attempting to break above recent highs amid renewed optimism in China’s tech sector. Investor confidence was bolstered by President Xi Jinping’s engagement with industry leaders and the AI-driven “DeepSeek” rally. Alibaba’s strong earnings further reinforced market sentiment, highlighting Beijing’s supportive policies aimed at stimulating economic growth.

In contrast, U.S. equities struggled, with Walmart’s weaker sales guidance signaling cracks in consumer spending, adding to market concerns.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The U.S. dollar extended its decline to a new low for 2025, with bearish momentum accelerating following the release of Initial Jobless Claims. The weaker-than-expected jobs data has further dented sentiment, reinforcing concerns that the U.S. labor market may be softening. Adding to the pressure, Trump’s renewed tariff threats and the ballooning U.S. national debt have eroded confidence in the greenback, prompting investors to seek alternatives. With market sentiment shifting away from the dollar, further downside pressure may persist unless a stronger economic catalyst emerges.

The Dollar Index has reached a new low and broken below its support level at 106.55, suggesting a bearish bias for the index. The RSI is returning to the oversold zone, while the MACD failed to break above the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 107.35, 108.40

Support level: 105.50, 103.70

Gold prices soared to a fresh all-time high above $2,950, before experiencing a slight pullback, stabilizing above $2,930. The precious metal continues to trade in an extremely bullish manner, fueled by escalating geopolitical tensions and mounting uncertainty over Trump’s tariff threats, which could spark a trade war with key partners. Meanwhile, the U.S. dollar remains subdued, further bolstering gold’s safe-haven appeal. With investors seeking protection amid global economic uncertainty, the yellow metal is poised to extend gains as long as the dollar weakness persists.

Gold prices have recorded new highs while remaining in a higher-high price pattern, suggesting a bullish bias for gold. The momentum indicators, including the RSI and the MACD, have been edging higher, suggesting that bullish momentum is gaining.

Resistance level: 2960.00, 3007.00

Support level: 2918.70, 2875.00

The British Pound extends its gains as resilient UK economic data dampens expectations for aggressive Bank of England (BoE) rate cuts. January’s hotter-than-expected inflation, coupled with accelerating wage growth and unexpected GDP expansion, has led markets to reassess the likelihood of two rate cuts this year. With the BoE meeting set for March 20, investors will closely watch upcoming retail sales and business activity data for further clarity. Persistent economic strength could reinforce a hawkish BoE stance, supporting further Pound appreciation.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 68, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.2720, 1.2800

Support level: 1.2635, 1.2515

The Euro strengthens amid US Dollar weakness but faces structural headwinds from geopolitical uncertainty and sluggish economic momentum. The Russia-Ukraine war continues to weigh on sentiment, exacerbated by reports of US-Russia negotiations that exclude Ukraine and the EU, raising concerns over Europe’s security framework. While the European Central Bank (ECB) maintains a cautious approach to rate cuts, weaker growth prospects relative to peers limit the Euro’s upside. Investors will monitor geopolitical developments and ECB signals for directional cues.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.0515, 1.0595

Support level: 1.0445, 1.0385

The Hang Seng Index (HSI) remains in a strong uptrend, driven by renewed optimism in China’s tech sector following President Xi Jinping’s engagement with industry leaders and the AI-driven “DeepSeek” rally. Alibaba’s earnings beat further bolstered sentiment, reinforcing confidence in Beijing’s supportive policies aimed at reviving economic growth. With strong corporate performance and policy tailwinds, the HSI is poised to sustain its bullish momentum in the near term.

HK50 is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 23240.00, 24915.00

Support level: 21125.00, 19015.00

The Dow Jones faces renewed pressure as weaker consumer sentiment clouds the US economic outlook. Walmart’s disappointing sales guidance signals potential cracks in consumer spending, while Federal Reserve officials continue to advocate a cautious stance on rate cuts. With inflation still above target and monetary policy expected to remain restrictive, equity markets may face heightened volatility, with investors closely tracking economic data and Fed commentary for further direction.

Dow Jones is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 44300.00, 45050.00

Support level: 43370.00, 41865.00

Crude oil prices continued to edge higher, defying weaker-than-expected U.S. crude inventory data. Market participants shifted their focus to heightened geopolitical risks, as escalating crossfire between Ukraine and Russia saw both sides targeting oil and gas facilities, fueling supply disruption concerns. However, potential diplomatic progress between the U.S. and Russia, following recent peace talks, could ease geopolitical tensions. If the U.S. reconsiders its sanctions on Russian oil, the market could see downward pressure on crude prices. Traders remain cautious, weighing supply risks against potential policy shifts.

Crude prices seemingly found support at the 70.40 mark, with a triple bottom formed at this level, and are edging higher. The RSI has been gaming, while the MACD has broken above the zero line, suggesting that the bullish momentum is gaining with oil prices.

Resistance level: 73.30, 75.25

Support level: 71.80, 70.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.