-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Market Summary

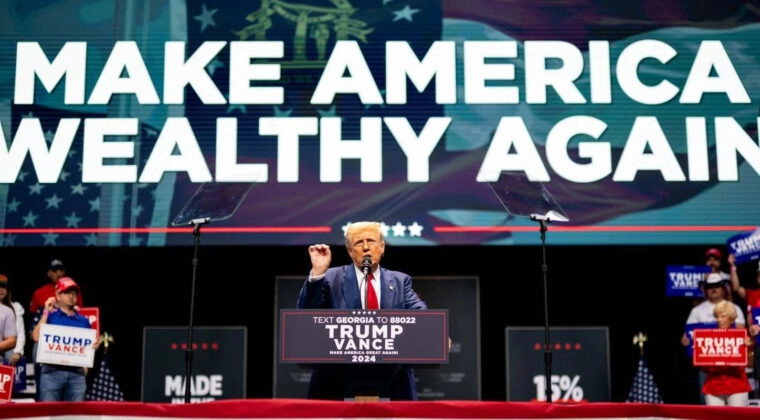

Tariffs have once again become a focal point, injecting fresh uncertainty into global markets. Over the weekend, U.S. President Donald Trump issued an executive order imposing 25% tariffs on imports from Canada and Mexico, along with a 10% levy on Chinese goods. The White House signaled that these measures could take effect as early as Tuesday, heightening market concerns.

Economists caution that these tariffs may exacerbate inflationary pressures, potentially prompting the Federal Reserve to slow the pace of interest rate cuts this year. Fed officials remain wary, citing an uncertain economic outlook weighed down by trade policy risks. Adding to the complexity, economic data showed the personal consumption expenditures (PCE) price index climbed 0.3% in December, marking a 2.6% year-on-year increase—suggesting persistent inflation that could delay Fed rate adjustments.

The Dollar Index strengthened as investors speculated that the tariffs might help narrow the U.S. budget deficit while simultaneously fueling inflationary pressures that support the greenback. Meanwhile, currencies of affected nations, including the Canadian dollar, Mexican peso, and Chinese yuan, declined.

Uncertainty surrounding tariffs also spurred a risk-off sentiment across global markets. Investors offloaded risk assets, triggering a sharp downturn in U.S. equities and cryptocurrencies as capital shifted toward traditional safe havens such as the U.S. dollar.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (100.0%) VS -25 bps (0%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar Index, which tracks the greenback against six major currencies, surged sharply as markets anticipated that President Trump’s newly imposed tariffs would reduce the U.S. budget deficit while adding inflationary pressures. The executive order signed over the weekend introduced 25% levies on imports from Canada and Mexico and a 10% duty on Chinese goods. This move has heightened trade tensions, with investors closely monitoring potential retaliatory measures.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 109.90, 111.60

Support level: 109.00, 107.95

Gold prices tumbled as the dollar’s sharp rally exerted downward pressure on the dollar-denominated metal. The greenback’s strength, driven by tariff-related inflation expectations, overshadowed gold’s safe-haven appeal. Investors remain cautious, with focus shifting to potential responses from Canada, Mexico, and China, which could trigger further volatility across financial markets.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the commodity might extend its losses after breakout since the RSI retreated from overbought territory.

Resistance level: 2830.00, 2845.00

Support level: 2775.00, 2740.00

EUR/USD extended its losses, plunging to a three-week low during early Asian trading as the dollar surged on tariff-driven risk aversion. Trump’s tariffs fueled a flight to safe-haven assets, strengthening the USD while weighing on the euro. The European Central Bank’s (ECB) recent 25 bps rate cut and signals of further easing have reinforced bearish sentiment around the shared currency, exacerbating the EUR/USD decline.

The EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 25, suggesting the pair might enter oversold territory.

Resistance level: 1.0355, 1.0535

Support level: 1.0195, 1.0100

The Canadian dollar plunged as Trump’s tariff decision directly targeted Canada, Mexico, and China. The U.S. move against its key trading partners sent shockwaves through forex markets, further pressuring the Canadian dollar. Additionally, stabilizing U.S. inflation data supported the dollar’s rally, exacerbating CAD’s losses.

USD/CAD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 78, suggesting the pair might enter overbought territory.

Resistance level: 1.4815, 1.4960

Support level: 1.4700, 1.4620

U.S. stock index futures slumped on Sunday evening after President Trump imposed sweeping tariffs on Canada, Mexico, and China, reigniting fears of a global trade war. The losses followed a negative session on Wall Street on Friday, as the PCE price index data met expectations for December, signaling persistent U.S. inflation. Trump’s tariff move is expected to add to inflationary pressures, further dampening investor sentiment.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the index might extend its losses since the RSI retreated from overbought territory.

Resistance level: 45380.00, 47230.00

Support level: 43920.00, 42900.00

Rising U.S. Treasury yields and escalating global trade uncertainties triggered a sharp sell-off in the crypto market, as investors shifted their portfolios toward safer assets, including the dollar. The sudden risk-off sentiment weighed on speculative assets, leading to a broad-based decline across cryptocurrencies.

BTC/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 23, suggesting the crypto might enter oversold territory.

Resistance level: 95560.00, 100455.00

Support level: 91000.00, 86000.00

The Hang Seng Index (HK50) remains under pressure as the latest tariff escalation raises concerns over China’s potential retaliatory measures. The 10% duty on Chinese imports could weigh on corporate earnings, adding further downside risks to Chinese equities. Investors are bracing for Beijing’s next move, with markets awaiting any countermeasures from Chinese policymakers.

HK50 is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 61, suggesting the index might extend its losses since the RSI retreated from overbought territory.

Resistance level: 20260.00, 21260.00

Support level: 19050.00, 18290.00

Crude oil prices jumped in Asian trading as Trump’s tariffs raised fears of potential supply chain disruptions. Canada and Mexico, key oil suppliers to the U.S., face 25% import tariffs, which could drive up costs for U.S. refiners and impact supply to the Midwest and Gulf Coast regions. The U.S. currently imports 4 million barrels per day from Canada and 500,000 barrels per day from Mexico. The higher tariffs could lead to increased fuel prices and potential production cuts in the coming weeks.

Crude oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 74.65, 76.85

Support level: 72.50, 69.85

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

Tariffs have once again become a focal point, injecting fresh uncertainty into global markets. Over the weekend, U.S. President Donald Trump issued an executive order imposing 25% tariffs on imports from Canada and Mexico, along with a 10% levy on Chinese goods. The White House signaled that these measures could take effect as early as Tuesday, heightening market concerns.

Economists caution that these tariffs may exacerbate inflationary pressures, potentially prompting the Federal Reserve to slow the pace of interest rate cuts this year. Fed officials remain wary, citing an uncertain economic outlook weighed down by trade policy risks. Adding to the complexity, economic data showed the personal consumption expenditures (PCE) price index climbed 0.3% in December, marking a 2.6% year-on-year increase—suggesting persistent inflation that could delay Fed rate adjustments.

The Dollar Index strengthened as investors speculated that the tariffs might help narrow the U.S. budget deficit while simultaneously fueling inflationary pressures that support the greenback. Meanwhile, currencies of affected nations, including the Canadian dollar, Mexican peso, and Chinese yuan, declined.

Uncertainty surrounding tariffs also spurred a risk-off sentiment across global markets. Investors offloaded risk assets, triggering a sharp downturn in U.S. equities and cryptocurrencies as capital shifted toward traditional safe havens such as the U.S. dollar.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (100.0%) VS -25 bps (0%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The U.S. Dollar Index, which tracks the greenback against six major currencies, surged sharply as markets anticipated that President Trump’s newly imposed tariffs would reduce the U.S. budget deficit while adding inflationary pressures. The executive order signed over the weekend introduced 25% levies on imports from Canada and Mexico and a 10% duty on Chinese goods. This move has heightened trade tensions, with investors closely monitoring potential retaliatory measures.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 109.90, 111.60

Support level: 109.00, 107.95

Gold prices tumbled as the dollar’s sharp rally exerted downward pressure on the dollar-denominated metal. The greenback’s strength, driven by tariff-related inflation expectations, overshadowed gold’s safe-haven appeal. Investors remain cautious, with focus shifting to potential responses from Canada, Mexico, and China, which could trigger further volatility across financial markets.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the commodity might extend its losses after breakout since the RSI retreated from overbought territory.

Resistance level: 2830.00, 2845.00

Support level: 2775.00, 2740.00

EUR/USD extended its losses, plunging to a three-week low during early Asian trading as the dollar surged on tariff-driven risk aversion. Trump’s tariffs fueled a flight to safe-haven assets, strengthening the USD while weighing on the euro. The European Central Bank’s (ECB) recent 25 bps rate cut and signals of further easing have reinforced bearish sentiment around the shared currency, exacerbating the EUR/USD decline.

The EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 25, suggesting the pair might enter oversold territory.

Resistance level: 1.0355, 1.0535

Support level: 1.0195, 1.0100

The Canadian dollar plunged as Trump’s tariff decision directly targeted Canada, Mexico, and China. The U.S. move against its key trading partners sent shockwaves through forex markets, further pressuring the Canadian dollar. Additionally, stabilizing U.S. inflation data supported the dollar’s rally, exacerbating CAD’s losses.

USD/CAD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 78, suggesting the pair might enter overbought territory.

Resistance level: 1.4815, 1.4960

Support level: 1.4700, 1.4620

U.S. stock index futures slumped on Sunday evening after President Trump imposed sweeping tariffs on Canada, Mexico, and China, reigniting fears of a global trade war. The losses followed a negative session on Wall Street on Friday, as the PCE price index data met expectations for December, signaling persistent U.S. inflation. Trump’s tariff move is expected to add to inflationary pressures, further dampening investor sentiment.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the index might extend its losses since the RSI retreated from overbought territory.

Resistance level: 45380.00, 47230.00

Support level: 43920.00, 42900.00

Rising U.S. Treasury yields and escalating global trade uncertainties triggered a sharp sell-off in the crypto market, as investors shifted their portfolios toward safer assets, including the dollar. The sudden risk-off sentiment weighed on speculative assets, leading to a broad-based decline across cryptocurrencies.

BTC/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 23, suggesting the crypto might enter oversold territory.

Resistance level: 95560.00, 100455.00

Support level: 91000.00, 86000.00

The Hang Seng Index (HK50) remains under pressure as the latest tariff escalation raises concerns over China’s potential retaliatory measures. The 10% duty on Chinese imports could weigh on corporate earnings, adding further downside risks to Chinese equities. Investors are bracing for Beijing’s next move, with markets awaiting any countermeasures from Chinese policymakers.

HK50 is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 61, suggesting the index might extend its losses since the RSI retreated from overbought territory.

Resistance level: 20260.00, 21260.00

Support level: 19050.00, 18290.00

Crude oil prices jumped in Asian trading as Trump’s tariffs raised fears of potential supply chain disruptions. Canada and Mexico, key oil suppliers to the U.S., face 25% import tariffs, which could drive up costs for U.S. refiners and impact supply to the Midwest and Gulf Coast regions. The U.S. currently imports 4 million barrels per day from Canada and 500,000 barrels per day from Mexico. The higher tariffs could lead to increased fuel prices and potential production cuts in the coming weeks.

Crude oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 74.65, 76.85

Support level: 72.50, 69.85

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.