-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

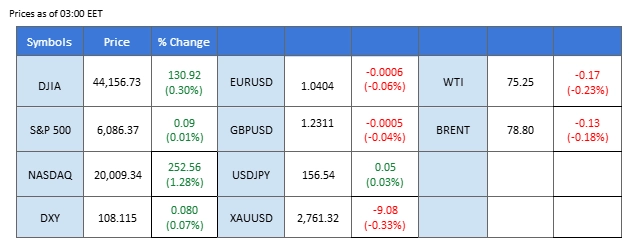

Market Summary

The excitement surrounding Donald Trump’s return to the White House subsided in the last session, with both the dollar and Wall Street trading in a more subdued manner. Attention now shifts to tomorrow’s Bank of Japan (BoJ) interest rate decision. If the BoJ raises rates to an 18-year high, it could tighten global liquidity, potentially weighing on risk assets such as equities and cryptocurrencies. The dollar’s volatility is also set to increase with the release of U.S. initial jobless claims today, which could directly impact its strength.

In the commodities market, gold remains elevated above $2,750 as caution lingers over Trump’s second term. Conversely, oil prices are under pressure due to uncertainty around Trump’s proposed trade tariffs, which could harm demand. Meanwhile, Bitcoin remains above the critical $100,000 level but faces short-term selling pressure as traders adopt a “buy the rumor, sell the news” approach following Trump’s inauguration. Despite this, the broader crypto market remains optimistic about Trump’s favorable stance on digital assets, with BTC likely to rally further if solid policies are introduced.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97.9%) VS -25 bps (2.1%)

Market Overview

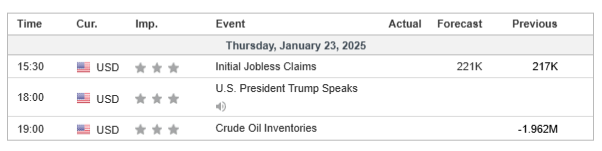

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

Market participants remained on edge as President Donald Trump extended his tariff threats to China and the EU, following his recent 25% tariffs on Canadian and Mexican imports. He hinted at a 10% tariff on Chinese goods starting February 1, citing fentanyl concerns, but with a trade review due by April 1, negotiations remain open. Despite the risks, market reactions were muted, as the proposed tariffs are far lower than the 60% Trump suggested during his campaign. The U.S. dollar remained subdued, while gold held near record highs as investors adopted a wait-and-see approach.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 109.00, 110.00

Support level: 107.95, 107.05

Gold prices extended their rally, reaching their highest level since last October, indicating a strong bullish momentum. The precious metal benefited from a subdued dollar, allowing it to gain further traction. Additionally, market participants remain cautious about the potential policies of the Trump administration, which could heighten financial market uncertainty and support gold’s safe-haven appeal. In the short term, gold is expected to maintain its bullish trajectory as long as prices remain above the critical $2,744 level.

Gold prices remain within their bullish trajectory. Traders may eye on the support level at the near $2744 mark. The RSI remains in the overbought zone, while the MACD reached a new high in the recent session, suggesting that gold is trading with strong bullish momentum.

Resistance level: 2789.00, 2830.00

Support level: 2718.35, 2665.00

The GBP/USD pair has reached above its previous high which suggests a structural break and a bullish bias for the pair. As the dollar has been soft in the recent session due to uncertainty surrounding Trump’s executive actions. the Pound Sterling is able to seize the chance and trade higher against the dollar. The U.S. initial Jobless Claims is due today which may serve as a pivotal factor for the pair’s price movement.

GBP/USD traded above its previous high level and formed a higher-high price pattern, suggesting a bullish bias for the pair. The RSI is flowing above the 50 level while the MACD remains above the zero line, suggesting that the pair is trading with bullish momentum.

Resistance level: 1.2410, 1.2505

Support level: 1.2220, 1.2140

The NZD/USD pair continues to trade near its recent high, supported by the bullish momentum of an inverted head-and-shoulders price pattern. The Kiwi was strengthened by yesterday’s upbeat CPI reading, which exceeded market expectations. Additionally, the market is evaluating the impact of new economic stimulus measures announced by the Chinese government, which could further boost the New Zealand dollar and support an extended rally for the pair.

The NZD/USD pair is poised at its recent high level, suggesting a bullish bias for the pair. The RSI continues to gain, while the MACD edged higher after breaking above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 0.5735, 0.5800

Support level: 0.5615, 0.5545

The Japanese yen is likely to extend its gains as markets anticipate the Bank of Japan’s largest rate hike in 18 years on Friday. Governor Kazuo Ueda is expected to raise the overnight call rate by 25 basis points to 0.5%, signaling confidence in sustained inflation and economic normalization. If confirmed, this would mark the BoJ’s most significant move since 2007, reinforcing expectations of further yen strength.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 57, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 156.00, 158.05

Support level: 155.00, 154.05

Major U.S. indices hit record highs, driven by strong earnings and enthusiasm over Trump’s AI investment plans. Netflix (NASDAQ: NFLX) surged nearly 10% after reporting 19 million new subscribers in Q4 2024, far exceeding expectations. The company’s revenue climbed to $9.5 billion, with net income up 12% YoY. Additionally, Trump’s unveiling of the $500 billion “Stargate” AI initiative, featuring OpenAI, Oracle (NYSE: ORCL), SoftBank (TYO: 9984), Microsoft (NASDAQ: MSFT), and NVIDIA (NASDAQ: NVDA), fueled further gains in AI-related stocks.

Dow Jones is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 45000.00, 47250.00

Support level: 43260.00, 41800.00

Bitcoin continues to ease but remains above its critical $100,000 support level, signaling a short-term bearish bias. The leading cryptocurrency faces selling pressure as traders adopt a “buy the rumor, sell the news” stance following Trump’s inauguration. However, optimism in the crypto market could resurface, as the SEC is expected to announce favorable regulatory measures for digital assets, potentially reigniting bullish momentum and driving BTC prices higher.

BTC/USD failed to reach its previous high and edge lower suggesting a short-term bearish bias for BTC. The RSI has slid below the 50 level while the MACD continues to edge lower, suggesting that the bullish momentum is diminishing.

Resistance level: 105450.00, 108130.00

Support level: 101775.00, 98765.00

Oil prices fell to a one-week low as investors assessed the impact of Trump’s escalating trade tariffs on global demand. Additionally, his declaration of a national energy emergency, rolling back environmental regulations, and withdrawing the U.S. from an international climate pact weighed on market sentiment, raising concerns over long-term supply dynamics.

Crude oil is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 77.05, 80.40

Support level: 75.05, 72.65

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!