-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

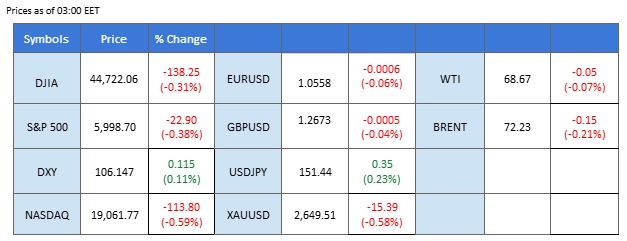

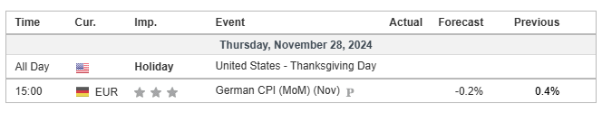

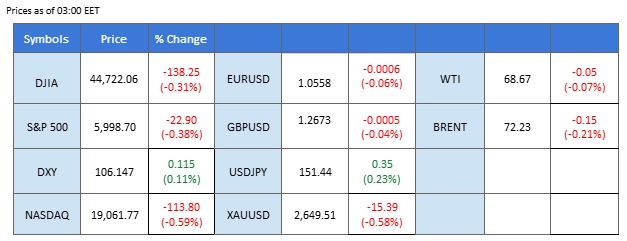

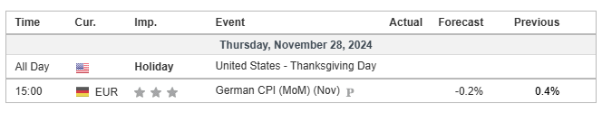

Market Summary

The U.S. Personal Consumption Expenditures (PCE) report, released yesterday, met market expectations but failed to deliver any surprises, resulting in continued weakness in the U.S. dollar. Simultaneously, long-term Treasury yields fell to their lowest levels in November. In contrast, the Japanese yen and euro emerged as the strongest currencies amid the dollar’s decline.

Meanwhile, the Reserve Bank of Australia (RBA) is expected to maintain its restrictive monetary policy in the near term, as a robust labor market poses a challenge to policy reversal. This outlook strengthens the Australian dollar’s position relative to its peers.

In the commodity space, gold and oil prices extended their losses as geopolitical tensions in the Middle East eased following the implementation of a ceasefire agreement.

In the cryptocurrency market, Bitcoin (BTC) and Ethereum (ETH) regained strength, with ETH rallying to its highest level since June, signaling strong bullish momentum.

Looking ahead, market activity may remain subdued as the U.S. observes the Thanksgiving holiday. Traders are advised to exercise caution in thinly traded markets.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (40.4%) VS -25 bps (59.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the greenback against a basket of six major currencies, edged higher in thin pre-holiday trade following U.S. economic data that aligned with expectations. U.S. GDP growth and Core PCE Price Index were both reported at 2.80%, in line with market forecasts. However, trading activity is expected to remain subdued due to the upcoming Thanksgiving holiday, limiting major market movements.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses after it successfully breakout since the RSI stays below the midline.

Resistance level: 107.60, 108.60

Support level: 106.10, 105.15

Gold prices fell during early Asian trading hours as the U.S. Dollar rebounded slightly, while profit-taking among traders added to downward pressure. The drop was amplified by light trading volumes ahead of the holiday. Despite the current dip, investors remain vigilant for developments in U.S. tariff policies, which could potentially reignite safe-haven demand for gold in the longer term.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2655.00, 2710.00

Support level: 2615.00, 2555.00

The GBP/USD pair climbed above its previous resistance at 1.2620, signaling a potential trend reversal. The move was largely driven by a weakening U.S. dollar, following the in-line U.S. PCE reading released yesterday. The data reinforced market expectations that the Federal Reserve may lean toward easing monetary policy in the near term.

The GBP/USD has jumped sharply by nearly 1% in the last session, suggesting a bullish bias for the pair. The RSI is reaching the overbought zone while the MACD has broken above the zero line, suggesting that the bullish momentum is gaining.

Resistance level:1.2700, 1.2805

Support level: 1.2620, 1.2505

The EUR/USD pair broke above its resistance at 1.0560, signaling a bullish outlook. Supported by the dollar’s underperformance, the pair continues to gain and is now approaching its previous high at 1.0605. Euro traders should monitor the upcoming Eurozone CPI data, expected to exceed the prior reading, potentially boosting the euro further.

EUR/USD continues to trade above its uptrend support level and has broken above its resistance level, suggesting a bullish signal for the pair. The RSI has risen above the 50 level while the MACD has broken above the zero line, suggesting that the pair is now trading with bullish momentum.

Resistance level: 1.0610, 1.0680

Support level: 1.0520, 1.0440

The Japanese yen stands out as one of the strongest currencies, with the pair dropping to a one-month low, signaling a bearish bias. The yen’s recent strength is fueled by speculation of a potential December BoJ rate hike. Tomorrow’s Tokyo Core CPI release will be closely watched for insights into the likelihood of this scenario.

USD/JPY has broken below from its support level, suggesting a bearish bias for the pair. The RSI has dropped into the oversold zone while the MACD continues to edge lower at the bottom, suggesting that the bearish momentum is gaining.

Resistance level: 153.65, 157.20

Support level: 148.70, 145.60

The US equity market traded flat as cautious sentiment ahead of Thanksgiving holiday limited activity. Economic data released yesterday showed no surprises, with GDP growth and the Core PCE Price Index both matching expectations at 2.8%, according to the Bureau of Economic Analysis. This alignment with forecasts kept investors in a wait-and-see mode, holding back from taking significant positions. Meanwhile, uncertainty surrounding potential policy announcements from Donald Trump adds another layer of caution. Investors are advised to monitor updates on US policy developments for potential market-moving cues.

The Dow is trading flat following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 45170.00, 47150.00

Support level: 44515.00, 43860.00

BTC surged over 5%, rebounding from its prior range, but has yet to reclaim its previous highs or confirm a trend reversal. BTC ETFs saw net inflows after two sessions of outflows, indicating a recovery in demand. With U.S. markets closed for Thanksgiving, BTC is expected to trade with reduced volatility. Traders are advised to remain cautious in the coming sessions.

BTC has rebounded from its critical support level near the 92250 mark but is yet to reach its previous high level, suggesting that BTC remains trading in its bearish trajectory. The RSI is hovering in between while the MACD remains below the zero line, suggesting that the bullish momentum is still lacking.

Resistance level: 96600.00, 101,900.00

Support level: 92250.00, 88500.00

Oil prices rebounded after two days of losses, mostly due to bargain buying. Previously, oil prices dropped sharply amid the ceasefire agreement between Israel and Hezbollah, which signaled a de-escalation of tensions in the Middle East. U.S. President Joe Biden confirmed the deal, which includes Israel’s phased withdrawal from Lebanon within 60 days. Further limiting losses, the Energy Information Administration reported a 1.8 million barrel draw in U.S. crude oil inventories, exceeding the forecasted 1.3 million barrel drop.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 69.95, 72.65

Support level: 66.90, 65.60

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The U.S. Personal Consumption Expenditures (PCE) report, released yesterday, met market expectations but failed to deliver any surprises, resulting in continued weakness in the U.S. dollar. Simultaneously, long-term Treasury yields fell to their lowest levels in November. In contrast, the Japanese yen and euro emerged as the strongest currencies amid the dollar’s decline.

Meanwhile, the Reserve Bank of Australia (RBA) is expected to maintain its restrictive monetary policy in the near term, as a robust labor market poses a challenge to policy reversal. This outlook strengthens the Australian dollar’s position relative to its peers.

In the commodity space, gold and oil prices extended their losses as geopolitical tensions in the Middle East eased following the implementation of a ceasefire agreement.

In the cryptocurrency market, Bitcoin (BTC) and Ethereum (ETH) regained strength, with ETH rallying to its highest level since June, signaling strong bullish momentum.

Looking ahead, market activity may remain subdued as the U.S. observes the Thanksgiving holiday. Traders are advised to exercise caution in thinly traded markets.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (40.4%) VS -25 bps (59.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the greenback against a basket of six major currencies, edged higher in thin pre-holiday trade following U.S. economic data that aligned with expectations. U.S. GDP growth and Core PCE Price Index were both reported at 2.80%, in line with market forecasts. However, trading activity is expected to remain subdued due to the upcoming Thanksgiving holiday, limiting major market movements.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses after it successfully breakout since the RSI stays below the midline.

Resistance level: 107.60, 108.60

Support level: 106.10, 105.15

Gold prices fell during early Asian trading hours as the U.S. Dollar rebounded slightly, while profit-taking among traders added to downward pressure. The drop was amplified by light trading volumes ahead of the holiday. Despite the current dip, investors remain vigilant for developments in U.S. tariff policies, which could potentially reignite safe-haven demand for gold in the longer term.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2655.00, 2710.00

Support level: 2615.00, 2555.00

The GBP/USD pair climbed above its previous resistance at 1.2620, signaling a potential trend reversal. The move was largely driven by a weakening U.S. dollar, following the in-line U.S. PCE reading released yesterday. The data reinforced market expectations that the Federal Reserve may lean toward easing monetary policy in the near term.

The GBP/USD has jumped sharply by nearly 1% in the last session, suggesting a bullish bias for the pair. The RSI is reaching the overbought zone while the MACD has broken above the zero line, suggesting that the bullish momentum is gaining.

Resistance level:1.2700, 1.2805

Support level: 1.2620, 1.2505

The EUR/USD pair broke above its resistance at 1.0560, signaling a bullish outlook. Supported by the dollar’s underperformance, the pair continues to gain and is now approaching its previous high at 1.0605. Euro traders should monitor the upcoming Eurozone CPI data, expected to exceed the prior reading, potentially boosting the euro further.

EUR/USD continues to trade above its uptrend support level and has broken above its resistance level, suggesting a bullish signal for the pair. The RSI has risen above the 50 level while the MACD has broken above the zero line, suggesting that the pair is now trading with bullish momentum.

Resistance level: 1.0610, 1.0680

Support level: 1.0520, 1.0440

The Japanese yen stands out as one of the strongest currencies, with the pair dropping to a one-month low, signaling a bearish bias. The yen’s recent strength is fueled by speculation of a potential December BoJ rate hike. Tomorrow’s Tokyo Core CPI release will be closely watched for insights into the likelihood of this scenario.

USD/JPY has broken below from its support level, suggesting a bearish bias for the pair. The RSI has dropped into the oversold zone while the MACD continues to edge lower at the bottom, suggesting that the bearish momentum is gaining.

Resistance level: 153.65, 157.20

Support level: 148.70, 145.60

The US equity market traded flat as cautious sentiment ahead of Thanksgiving holiday limited activity. Economic data released yesterday showed no surprises, with GDP growth and the Core PCE Price Index both matching expectations at 2.8%, according to the Bureau of Economic Analysis. This alignment with forecasts kept investors in a wait-and-see mode, holding back from taking significant positions. Meanwhile, uncertainty surrounding potential policy announcements from Donald Trump adds another layer of caution. Investors are advised to monitor updates on US policy developments for potential market-moving cues.

The Dow is trading flat following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 45170.00, 47150.00

Support level: 44515.00, 43860.00

BTC surged over 5%, rebounding from its prior range, but has yet to reclaim its previous highs or confirm a trend reversal. BTC ETFs saw net inflows after two sessions of outflows, indicating a recovery in demand. With U.S. markets closed for Thanksgiving, BTC is expected to trade with reduced volatility. Traders are advised to remain cautious in the coming sessions.

BTC has rebounded from its critical support level near the 92250 mark but is yet to reach its previous high level, suggesting that BTC remains trading in its bearish trajectory. The RSI is hovering in between while the MACD remains below the zero line, suggesting that the bullish momentum is still lacking.

Resistance level: 96600.00, 101,900.00

Support level: 92250.00, 88500.00

Oil prices rebounded after two days of losses, mostly due to bargain buying. Previously, oil prices dropped sharply amid the ceasefire agreement between Israel and Hezbollah, which signaled a de-escalation of tensions in the Middle East. U.S. President Joe Biden confirmed the deal, which includes Israel’s phased withdrawal from Lebanon within 60 days. Further limiting losses, the Energy Information Administration reported a 1.8 million barrel draw in U.S. crude oil inventories, exceeding the forecasted 1.3 million barrel drop.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 69.95, 72.65

Support level: 66.90, 65.60

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.