-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

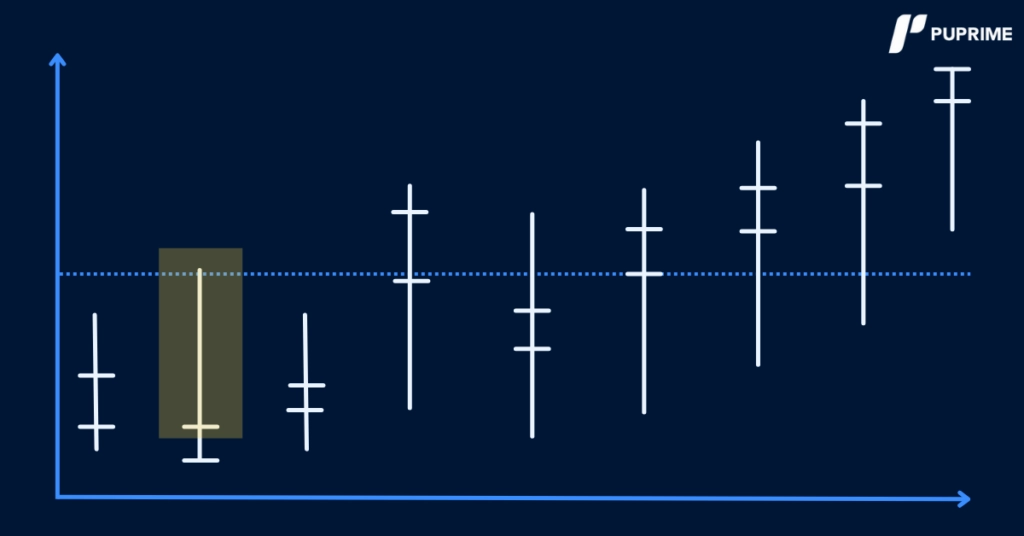

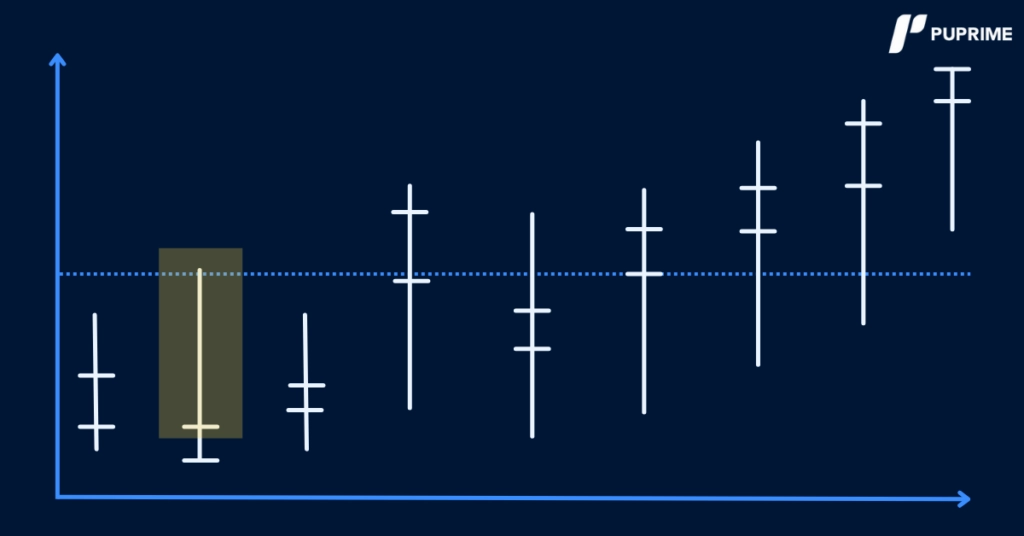

An Inverted Hammer candlestick is one of the most famous charting tools in technical analysis. It is used to identify a potential reversal pattern from bearish to bullish. This trend may occur after a downtrend or a corrective phase within an uptrend, which suggests that selling pressure may slowly decrease and a shift towards upward momentum may be imminent.

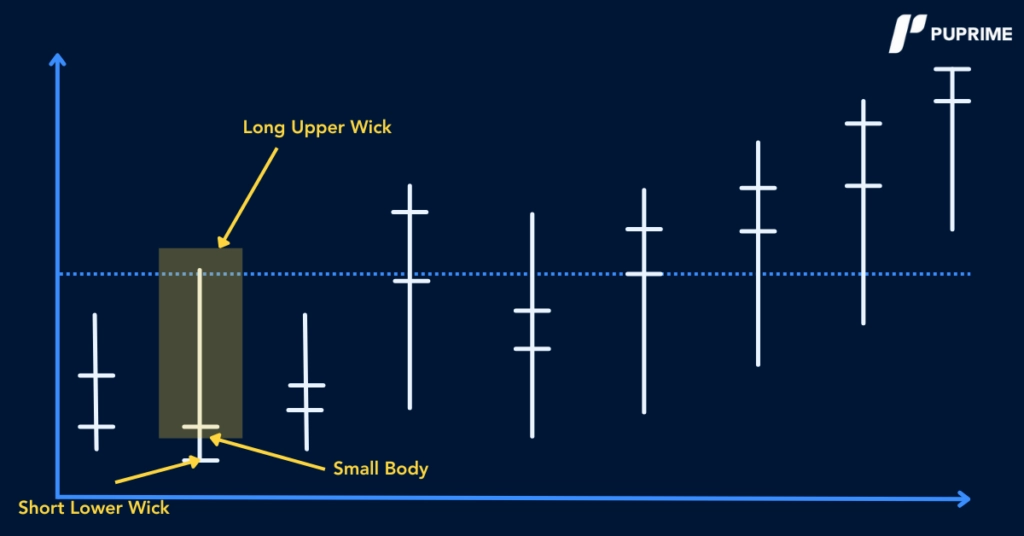

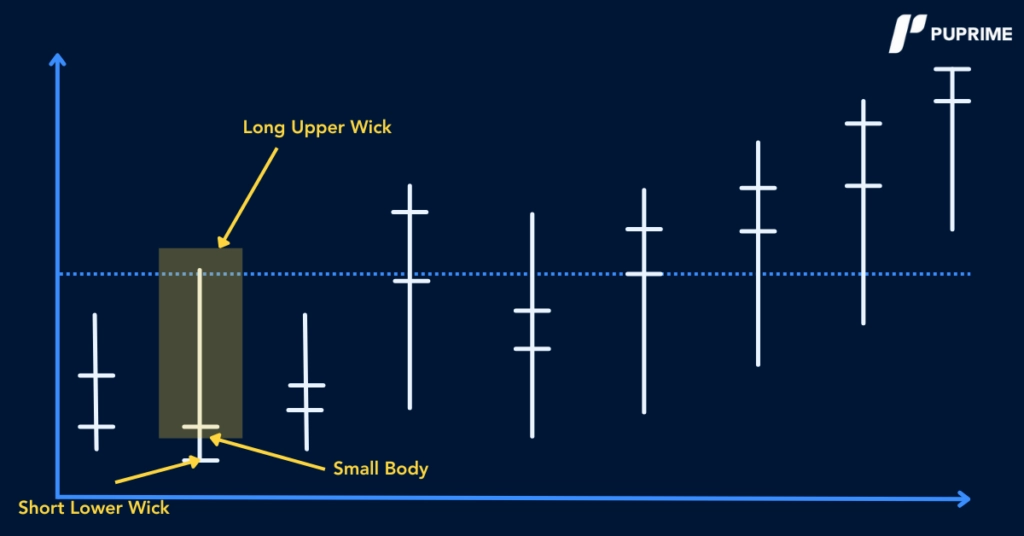

This type of candlestick is easy to identify as it has a distinct shape with three main components: a small body, a short lower wick, and a long upper wick. The unique shape of this candlestick represents key market dynamics during the session. Sellers initially dominated the price movement, but the buyers stepped in and drove the price movement up. This shows a shift in market sentiment as the downward trend is faced with resistance from the buyers.

After confirming the candlestick form using technical indicators like increased trading volume or follow-through price action, traders can enter the trade and gain profits. It is important to note that the pattern itself does not guarantee a reversal but acts as an early warning sign that can prompt traders to take action and look for further confirmation. Understanding the inverted hammer candlestick patterns is essential for traders and investors who are looking to capitalise on trend reversals. There are quite a few identifying key features of this type of candlestick. Mastering this pattern takes time and practice.

The Inverted Hammer candlestick is a distinct pattern used in technical analysis and can help identify a potential bullish reversal signal. Its unique structure makes it easier for traders looking to gain profits from market shifts to identify the pattern and enter the trade in a timely fashion. The pattern has three main components: a long upper wick, a short lower wick, and a small body. Each component represents the traders’ key sentiment, and the Inverted Hammer’s formation resembles that of a hammer turned upside down.

This is the most prominent feature of the candlestick. This indicates that buyers pushed the price higher during the season but were unable to maintain control over it.

The minimal presence of this lower wick suggests limited downward movement during the session. In other words, the sellers struggle to push prices lower.

The small body is seen near the bottom of the candlestick. It reflects the narrow difference between the opening and closing prices, which signals the overall market’s indecisiveness.

The inverted hammer candlestick serves as a reliable indicator of a potential bullish reversal pattern; however, confirmation is crucial. To confirm, traders look for subsequent price movement, increasing trading volume, and alignment with support levels. Once there is a strong indication of the bullish sentiment, traders can enter the trade and gain profits on upward price movements. While this is a famous pattern for traders to identify a reversal in the market price, the success of a trade depends on many factors and the competency of the trader, which comes from experience.

Accurately identifying and interpreting the inverted hammer candlestick pattern is important for traders looking to identify a potential bullish reversal and capitalise on price momentum. Here is a practical guide on how to recognise the pattern effectively:

The pattern hints at a potential trend reversal from downtrend to uptrend, which means that it sustains a position in a downtrend for some time. Monitor the location of the downtrend closely, as it will signal a potential turning point where selling pressure is weakening.

The pattern has a distinct structure that is hard to miss. When identifying this type of candlestick, make sure to clearly identify all three components: the small body, the long upper wick, and the short lower wick.

An increased trading volume during the inverted hammer session can strengthen the pattern’s credibility.

After carefully identifying the pattern, traders must confirm the reversal before entering a trade and wait for a trend reversal to make a profit. This is because the pattern itself does not confirm a trend reversal. To confirm the reversal, traders look for:

A strong bullish candlestick after the bearish session, especially one with a higher close, confirms the change in buyer sentiment and the buying momentum. This is a strong indicator that the market might be moving upward.

If the price breaks above the high of the inverted hammer in subsequent sessions, it can be taken as a strong signal that a reversal is imminent.

Additional bullish reversal indicators that traders can use include support levels, trendlines, and momentum indicators like the Relative Strength Index (RSI). These indicators can provide additional confirmation of a potential trend reversal, enhancing the reliability of the inverted hammer pattern.

After confirmation, the traders have enough evidence that there will be a trend reversal. Avoid jumping into a trade after identifying the inverted hammer candlestick to minimise unexpected loss, and always wait for additional bullish signs. The reliability of the pattern improves when it forms near the key support levels or after an extended period of downtrend. Mindfully placing your risk mitigation strategies, like a stop-loss order just below the inverted hammer, can help limit the risk.

A few other patterns, including the Doji Hammer and Standard Bullish Hammer, share similarities with the inverted hammer pattern. It is crucial to differentiate these patterns before planning your trade based on them. Here, we look at these patterns’ similarities and differences.

These two patterns are quite similar but share a few subtle differences that are crucial to their unique use.

| Feature | Inverted Hammer | Doji Hammer |

| Shape | A small body with a long upper wick and a short lower wick | Extremely small body with shadows on either or both sides |

| Placement | Generally appears after a downtrend | Can appear in both uptrends and downtrends, hinting at indecision |

| Implications | Needs confirmation of a bullish sentiment | Needs confirmation but reflects strong market indecision |

The inverted hammer candlestick pattern is more conclusive than a Doji hammer candlestick pattern in indicating a bullish reversal, provided that in both cases, a confirmation is required. The Doji pattern indicates a strong indecision in the market, and the final swing depends on additional factors like changes in trading volume and trends.

The inverted hammer and standard bullish hammer patterns are both reversal patterns but differ slightly in structure and context.

| Feature | Inverted Hammer | Standard Bullish Hammer |

| Shape | A small body with a long upper wick and a short lower wick | Small body at the upper end, long lower wick, and an absent or short upper shadow |

| Placement | Generally appears after a downtrend | Generally appears after a downtrend |

| Implications | Needs confirmation of a bullish sentiment | Indicates a strong buying pressure |

Both patterns signal bullish reversals, but the bullish hammer pattern shows strong buying pressure and rejects lower levels.

The inverted hammer candlestick pattern is a strong indicator of a bullish reversal and is used for technical analysis. By identifying this pattern and then confirming a bullish reversal, traders can identify potential buying opportunities and make profits. This pattern typically appears after a session of bearish candles and at the end of a downtrend. It signals that selling pressure is losing its strength and that buyers are jumping in to gain control. To capitalise on upward momentum, traders must understand the sentiment shift and look for reversal points.

Confirming the trend before entering the trade is crucial for traders. To confirm, traders can look for support from high trading volume, which indicates increased market participation from buyers. The Relative Strength Index (RSI) can also help traders confirm a potential bullish reversal. The candlestick pattern can serve as a valuable tool for identifying opportunities to enter long positions and gain profits.

The inverted hammer candlestick can appear in two colours: red, which indicates a bearish close, and green, which indicates a bullish close. Both coloured patterns share the same structure but differ in the opening price at the end of the session. The difference between the two has meaningful implications on the overall market and volume, which the traders can use to their advantage.

A red inverted hammer indicates that the sellers hold a slight upper hand over the buyers at the end of the session despite the buyer’s attempt to push the prices higher. This may reflect a lingering sense of bearish sentiment and make the confirmation of the reversal through subsequent candles even more crucial.

A green inverted hammer indicates that the buyers hold a slight upper hand over the sellers at the end of the session. This still shows indecision in the market, but if the candle appears after a downtrend, the variation can be viewed as a strong indication of a potential signal reversal.

The effectiveness of both candlesticks depends heavily on the market context. For example, a strong bullish candle that confirms the pattern, despite being red or green, strengthens the case for trend reversal. Volume analysis also plays a crucial role in interpreting these patterns. In the case of green inverted hammers, a strong volume further strengthens the idea of bullish momentum. In the case of a red inverted hammer, an increased volume can indicate a batter between the sellers and the buyers. Ultimately, despite its colour, the key to using the pattern to your advantage is accurately confirming the pattern using technical tools and patience.

To maximise the effectiveness of an inverted hammer in trading, traders use various indicators that can help confirm the signal through technical analysis and improve decision-making. Following are a few strategies that use these indicators to aid in trading with the inverted hammer pattern:

If used with the inverted hammer pattern, the RSI, or Relative Strength Index, can confirm the bullish reversal signal. The pattern’s reliability increases as the RSI begins to move upwards in subsequent sessions, which could be a strong signal for a shift in momentum.

Moving averages are a great way to validate a trend. For example, if the inverted hammer pattern appears slightly below a key moving average, it may indicate an uptrend.

The legitimacy of the pattern increases as the trading volume increases during its formation. A strong volume suggests greater buyer participation and that a trend reversal is imminent.

These are a few of the strategies that use patterns and other technical tools to confirm the signal. Once you have familiarised yourself with what each technical tool means and how you can use it to your advantage, you can follow the following step-by-step procedure to trade with an inverted hammer pattern:

The first step is to identify the pattern in the right market context. Look for the hammer at the end of a downtrend or during a pullback in an uptrend. Confirm the three components of the pattern.

Be patient and wait for a bullish confirmation candle in the subsequent session. To validate the signal, use additional indicators like moving averages, RSI, and trendlines.

Evaluate the changing trading volume during the formation of the pattern. A high volume supports the likelihood of a trend reversal.

Once you confirm the pattern and the trend reversal, it’s time to plan your trade. Enter a long position after the confirmation candle closes above the high of the inverted hammer. Always deploy risk mitigation strategies like a stop-loss order.

Monitor the additional indicators closely and see how they perform. Adjust your trade accordingly, and if in doubt, close the trade to limit your losses.

A well-rounded trading strategy takes time and can be formed from experience. The best thing you can do is research and take one step at a time to learn the art of trading and gain profits.

In addition to using the inverted hammer pattern as an indicator for trend reversal, traders have formed unique takes on the pattern and its use. Here we look at a few of these unique perspectives on inverted hammer candlestick patterns:

One of the biggest insights the inverted hammer pattern offers is its reliability changes across longer and short timeframes. In longer timeframes like daily or weekly charts, the pattern is seen to be more reliable, and when combined with support or resistance zones, it surely provides strong signals for long-term trend reversals. In the case of shorter timeframes like intraday or hourly trades, the inverted hammer may be seen more frequently, but it should be used with caution. The volatility and noise in short timeframes can produce false signals. To confirm the pattern, traders must use additional tools.

The inverted hammer pattern can be a very useful tool for indicating a potential trend reversal around high-volatility periods, which may be due to a major political event or during earnings announcements. In such conditions, a green inverted hammer after a strong decline might indicate that buyers are beginning to push for higher levels and attempting to break through the volatility barrier.

However, in volatile environments, analysts strongly suggest that confirmation is non-negotiable. A simple but most effective trick here is to look for strong follow-through candles to ensure that sudden, precise movement is not just a short-lived reaction but a good entry point for a profitable trade.

The inverted hammer candlestick is a widely recognised and used technical analysis tool, but it is not without limitations. Following are some of the most important limitations of this type of candlestick pattern:

Relying solely on any pattern without confirmation can result in losses because patterns have a tendency to generate false signals, especially on shorter timeframes.

In sideways or range-bound markets, the inverted hammer pattern might not be a credible source of signal reversal.

The reliability of the inverted hammer pattern varies across different market contexts. In low-liquidity markets, the pattern may form without any real change in sentiment because the price movements are erratic. In high-volatility markets, sudden price hikes can form different patterns, including the inverted hammer, which can be misleading and result in a loss if traded.

Therefore, it is highly recommended that before trading any pattern, its characteristics and limitations be carefully studied so as not to trade blindly.

The inverted hammer pattern is an essential tool in technical analysis and is of great importance to any trader or investor. This pattern identifies a potential bullish reversal after a standing downtrend, which is indicative of buyer interest. This pattern can help traders enter a trade at the most optimum time and make considerable profits when used carefully. For this, it is important to understand this formation’s shape and value truly. Each component of this pattern has a meaning which represents the market sentiment and context. By combining these sentiments along with additional confirmation signals, this pattern can be used to one’s benefit.

For traders starting out in the world, practice identifying patterns and applying them on demo accounts before applying them to the real world with real financial stakes. This will not only help build confidence but also deepen your understanding of the market and its context, ultimately helping you make viable trading decisions.

Step into the world of trading with confidence today. Open a free PU Prime live trading account today to experience real-time market action, or refine your strategies risk-free with our demo account.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

An Inverted Hammer candlestick is one of the most famous charting tools in technical analysis. It is used to identify a potential reversal pattern from bearish to bullish. This trend may occur after a downtrend or a corrective phase within an uptrend, which suggests that selling pressure may slowly decrease and a shift towards upward momentum may be imminent.

This type of candlestick is easy to identify as it has a distinct shape with three main components: a small body, a short lower wick, and a long upper wick. The unique shape of this candlestick represents key market dynamics during the session. Sellers initially dominated the price movement, but the buyers stepped in and drove the price movement up. This shows a shift in market sentiment as the downward trend is faced with resistance from the buyers.

After confirming the candlestick form using technical indicators like increased trading volume or follow-through price action, traders can enter the trade and gain profits. It is important to note that the pattern itself does not guarantee a reversal but acts as an early warning sign that can prompt traders to take action and look for further confirmation. Understanding the inverted hammer candlestick patterns is essential for traders and investors who are looking to capitalise on trend reversals. There are quite a few identifying key features of this type of candlestick. Mastering this pattern takes time and practice.

The Inverted Hammer candlestick is a distinct pattern used in technical analysis and can help identify a potential bullish reversal signal. Its unique structure makes it easier for traders looking to gain profits from market shifts to identify the pattern and enter the trade in a timely fashion. The pattern has three main components: a long upper wick, a short lower wick, and a small body. Each component represents the traders’ key sentiment, and the Inverted Hammer’s formation resembles that of a hammer turned upside down.

This is the most prominent feature of the candlestick. This indicates that buyers pushed the price higher during the season but were unable to maintain control over it.

The minimal presence of this lower wick suggests limited downward movement during the session. In other words, the sellers struggle to push prices lower.

The small body is seen near the bottom of the candlestick. It reflects the narrow difference between the opening and closing prices, which signals the overall market’s indecisiveness.

The inverted hammer candlestick serves as a reliable indicator of a potential bullish reversal pattern; however, confirmation is crucial. To confirm, traders look for subsequent price movement, increasing trading volume, and alignment with support levels. Once there is a strong indication of the bullish sentiment, traders can enter the trade and gain profits on upward price movements. While this is a famous pattern for traders to identify a reversal in the market price, the success of a trade depends on many factors and the competency of the trader, which comes from experience.

Accurately identifying and interpreting the inverted hammer candlestick pattern is important for traders looking to identify a potential bullish reversal and capitalise on price momentum. Here is a practical guide on how to recognise the pattern effectively:

The pattern hints at a potential trend reversal from downtrend to uptrend, which means that it sustains a position in a downtrend for some time. Monitor the location of the downtrend closely, as it will signal a potential turning point where selling pressure is weakening.

The pattern has a distinct structure that is hard to miss. When identifying this type of candlestick, make sure to clearly identify all three components: the small body, the long upper wick, and the short lower wick.

An increased trading volume during the inverted hammer session can strengthen the pattern’s credibility.

After carefully identifying the pattern, traders must confirm the reversal before entering a trade and wait for a trend reversal to make a profit. This is because the pattern itself does not confirm a trend reversal. To confirm the reversal, traders look for:

A strong bullish candlestick after the bearish session, especially one with a higher close, confirms the change in buyer sentiment and the buying momentum. This is a strong indicator that the market might be moving upward.

If the price breaks above the high of the inverted hammer in subsequent sessions, it can be taken as a strong signal that a reversal is imminent.

Additional bullish reversal indicators that traders can use include support levels, trendlines, and momentum indicators like the Relative Strength Index (RSI). These indicators can provide additional confirmation of a potential trend reversal, enhancing the reliability of the inverted hammer pattern.

After confirmation, the traders have enough evidence that there will be a trend reversal. Avoid jumping into a trade after identifying the inverted hammer candlestick to minimise unexpected loss, and always wait for additional bullish signs. The reliability of the pattern improves when it forms near the key support levels or after an extended period of downtrend. Mindfully placing your risk mitigation strategies, like a stop-loss order just below the inverted hammer, can help limit the risk.

A few other patterns, including the Doji Hammer and Standard Bullish Hammer, share similarities with the inverted hammer pattern. It is crucial to differentiate these patterns before planning your trade based on them. Here, we look at these patterns’ similarities and differences.

These two patterns are quite similar but share a few subtle differences that are crucial to their unique use.

| Feature | Inverted Hammer | Doji Hammer |

| Shape | A small body with a long upper wick and a short lower wick | Extremely small body with shadows on either or both sides |

| Placement | Generally appears after a downtrend | Can appear in both uptrends and downtrends, hinting at indecision |

| Implications | Needs confirmation of a bullish sentiment | Needs confirmation but reflects strong market indecision |

The inverted hammer candlestick pattern is more conclusive than a Doji hammer candlestick pattern in indicating a bullish reversal, provided that in both cases, a confirmation is required. The Doji pattern indicates a strong indecision in the market, and the final swing depends on additional factors like changes in trading volume and trends.

The inverted hammer and standard bullish hammer patterns are both reversal patterns but differ slightly in structure and context.

| Feature | Inverted Hammer | Standard Bullish Hammer |

| Shape | A small body with a long upper wick and a short lower wick | Small body at the upper end, long lower wick, and an absent or short upper shadow |

| Placement | Generally appears after a downtrend | Generally appears after a downtrend |

| Implications | Needs confirmation of a bullish sentiment | Indicates a strong buying pressure |

Both patterns signal bullish reversals, but the bullish hammer pattern shows strong buying pressure and rejects lower levels.

The inverted hammer candlestick pattern is a strong indicator of a bullish reversal and is used for technical analysis. By identifying this pattern and then confirming a bullish reversal, traders can identify potential buying opportunities and make profits. This pattern typically appears after a session of bearish candles and at the end of a downtrend. It signals that selling pressure is losing its strength and that buyers are jumping in to gain control. To capitalise on upward momentum, traders must understand the sentiment shift and look for reversal points.

Confirming the trend before entering the trade is crucial for traders. To confirm, traders can look for support from high trading volume, which indicates increased market participation from buyers. The Relative Strength Index (RSI) can also help traders confirm a potential bullish reversal. The candlestick pattern can serve as a valuable tool for identifying opportunities to enter long positions and gain profits.

The inverted hammer candlestick can appear in two colours: red, which indicates a bearish close, and green, which indicates a bullish close. Both coloured patterns share the same structure but differ in the opening price at the end of the session. The difference between the two has meaningful implications on the overall market and volume, which the traders can use to their advantage.

A red inverted hammer indicates that the sellers hold a slight upper hand over the buyers at the end of the session despite the buyer’s attempt to push the prices higher. This may reflect a lingering sense of bearish sentiment and make the confirmation of the reversal through subsequent candles even more crucial.

A green inverted hammer indicates that the buyers hold a slight upper hand over the sellers at the end of the session. This still shows indecision in the market, but if the candle appears after a downtrend, the variation can be viewed as a strong indication of a potential signal reversal.

The effectiveness of both candlesticks depends heavily on the market context. For example, a strong bullish candle that confirms the pattern, despite being red or green, strengthens the case for trend reversal. Volume analysis also plays a crucial role in interpreting these patterns. In the case of green inverted hammers, a strong volume further strengthens the idea of bullish momentum. In the case of a red inverted hammer, an increased volume can indicate a batter between the sellers and the buyers. Ultimately, despite its colour, the key to using the pattern to your advantage is accurately confirming the pattern using technical tools and patience.

To maximise the effectiveness of an inverted hammer in trading, traders use various indicators that can help confirm the signal through technical analysis and improve decision-making. Following are a few strategies that use these indicators to aid in trading with the inverted hammer pattern:

If used with the inverted hammer pattern, the RSI, or Relative Strength Index, can confirm the bullish reversal signal. The pattern’s reliability increases as the RSI begins to move upwards in subsequent sessions, which could be a strong signal for a shift in momentum.

Moving averages are a great way to validate a trend. For example, if the inverted hammer pattern appears slightly below a key moving average, it may indicate an uptrend.

The legitimacy of the pattern increases as the trading volume increases during its formation. A strong volume suggests greater buyer participation and that a trend reversal is imminent.

These are a few of the strategies that use patterns and other technical tools to confirm the signal. Once you have familiarised yourself with what each technical tool means and how you can use it to your advantage, you can follow the following step-by-step procedure to trade with an inverted hammer pattern:

The first step is to identify the pattern in the right market context. Look for the hammer at the end of a downtrend or during a pullback in an uptrend. Confirm the three components of the pattern.

Be patient and wait for a bullish confirmation candle in the subsequent session. To validate the signal, use additional indicators like moving averages, RSI, and trendlines.

Evaluate the changing trading volume during the formation of the pattern. A high volume supports the likelihood of a trend reversal.

Once you confirm the pattern and the trend reversal, it’s time to plan your trade. Enter a long position after the confirmation candle closes above the high of the inverted hammer. Always deploy risk mitigation strategies like a stop-loss order.

Monitor the additional indicators closely and see how they perform. Adjust your trade accordingly, and if in doubt, close the trade to limit your losses.

A well-rounded trading strategy takes time and can be formed from experience. The best thing you can do is research and take one step at a time to learn the art of trading and gain profits.

In addition to using the inverted hammer pattern as an indicator for trend reversal, traders have formed unique takes on the pattern and its use. Here we look at a few of these unique perspectives on inverted hammer candlestick patterns:

One of the biggest insights the inverted hammer pattern offers is its reliability changes across longer and short timeframes. In longer timeframes like daily or weekly charts, the pattern is seen to be more reliable, and when combined with support or resistance zones, it surely provides strong signals for long-term trend reversals. In the case of shorter timeframes like intraday or hourly trades, the inverted hammer may be seen more frequently, but it should be used with caution. The volatility and noise in short timeframes can produce false signals. To confirm the pattern, traders must use additional tools.

The inverted hammer pattern can be a very useful tool for indicating a potential trend reversal around high-volatility periods, which may be due to a major political event or during earnings announcements. In such conditions, a green inverted hammer after a strong decline might indicate that buyers are beginning to push for higher levels and attempting to break through the volatility barrier.

However, in volatile environments, analysts strongly suggest that confirmation is non-negotiable. A simple but most effective trick here is to look for strong follow-through candles to ensure that sudden, precise movement is not just a short-lived reaction but a good entry point for a profitable trade.

The inverted hammer candlestick is a widely recognised and used technical analysis tool, but it is not without limitations. Following are some of the most important limitations of this type of candlestick pattern:

Relying solely on any pattern without confirmation can result in losses because patterns have a tendency to generate false signals, especially on shorter timeframes.

In sideways or range-bound markets, the inverted hammer pattern might not be a credible source of signal reversal.

The reliability of the inverted hammer pattern varies across different market contexts. In low-liquidity markets, the pattern may form without any real change in sentiment because the price movements are erratic. In high-volatility markets, sudden price hikes can form different patterns, including the inverted hammer, which can be misleading and result in a loss if traded.

Therefore, it is highly recommended that before trading any pattern, its characteristics and limitations be carefully studied so as not to trade blindly.

The inverted hammer pattern is an essential tool in technical analysis and is of great importance to any trader or investor. This pattern identifies a potential bullish reversal after a standing downtrend, which is indicative of buyer interest. This pattern can help traders enter a trade at the most optimum time and make considerable profits when used carefully. For this, it is important to understand this formation’s shape and value truly. Each component of this pattern has a meaning which represents the market sentiment and context. By combining these sentiments along with additional confirmation signals, this pattern can be used to one’s benefit.

For traders starting out in the world, practice identifying patterns and applying them on demo accounts before applying them to the real world with real financial stakes. This will not only help build confidence but also deepen your understanding of the market and its context, ultimately helping you make viable trading decisions.

Step into the world of trading with confidence today. Open a free PU Prime live trading account today to experience real-time market action, or refine your strategies risk-free with our demo account.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.