-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

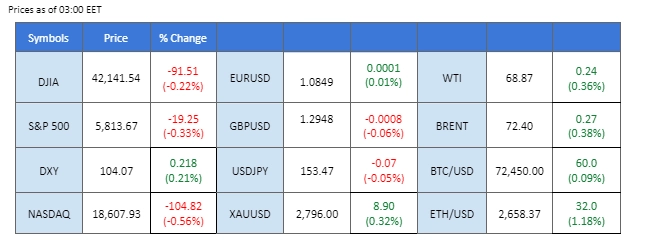

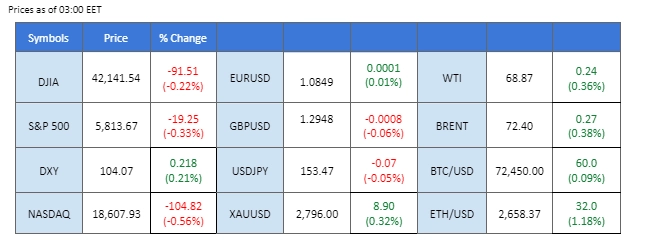

Market Summary

The dollar faced pressure from the GDP reading released yesterday, which came in lower than market expectations. However, amidst prevailing risk-off sentiment, the dollar managed to find support above the $104.00 mark. Today’s highly anticipated U.S. PCE reading, the Fed’s preferred inflation gauge, is expected to provide crucial insights into upcoming monetary policy decisions and their implications for the dollar’s strength.

On Wall Street, the Nasdaq was negatively impacted by disappointing earnings from Meta Platforms, alongside a slower earnings forecast for Microsoft’s cloud business. As the tech-heavy index hovers near recent peak levels, traders are closely watching today’s earnings reports from Apple Inc. and Amazon Inc., which are likely to influence the index’s price action.

In the commodity market, gold rose nearly 0.5% in the last session, marking its fifth consecutive gain. The precious metal has attracted demand ahead of the upcoming U.S. election and is expected to continue its upward trend as the election date approaches. Meanwhile, oil prices received a boost from a decrease in U.S. crude inventories reported last night. Additionally, OPEC+ is reportedly delaying its planned full restoration of oil production in December, as the demand outlook for oil remains lackluster.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (4.4%) VS -25 bps (95.6%)

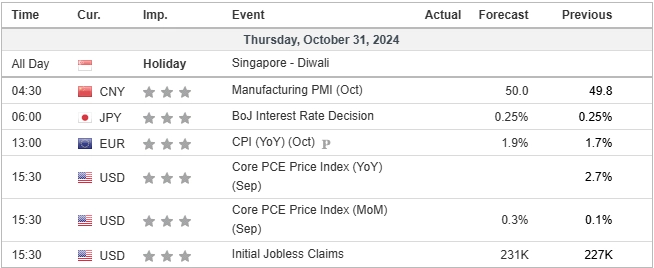

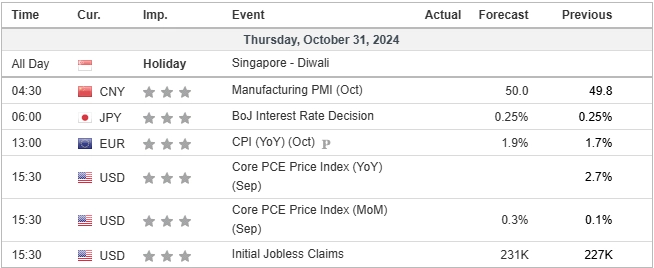

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its pullback in the last session but found support just above the 104.00 level, indicating it remains on an uptrend trajectory. The dollar faced pressure from a lower-than-expected GDP reading, which weighed on sentiment. Market participants are now closely watching the U.S. PCE reading due today, which is expected to have a direct impact on the index’s performance. A break below the 104.00 mark could signal a bearish shift for the index, potentially paving the way for further declines if economic data continues to disappoint.

The dollar index’s bullish momentum is easing drastically, with the RSI dropping below the 50 level while the MACD edge is lower than the zero line. A break below the 104.00 mark shall be a bearish signal for the index.

Resistance level: 104.95, 105.55

Support level: 103.95, 103.20

Gold prices surged to a new high, touching the $2,790 mark for the first time, reflecting a bullish bias for the precious metal. The rise was primarily fueled by a softer dollar, weighed down by recent weaker U.S. economic indicators. With the U.S. election just a week away, market participants are seeking safe-haven assets like gold to navigate potential volatility. This election-driven sentiment, alongside existing geopolitical concerns and economic uncertainties, is expected to sustain upward momentum for gold in the near term, possibly pushing prices closer to the $2,800 mark.

Gold prices gained for the 3rd session this week after the gold found support at $2720 levels, suggesting a strong bullish signal for the gold. The RSI remains close to the overbought zone, while the MACD edged higher in the last session, suggesting the bullish momentum remains intact with the gold.

Resistance level: 2795.00, 2810.00

Support level: 2775.00, 2755.00

The GBP/USD pair remains under pressure from recent weak economic indicators and is struggling to hold above the 1.3000 level, despite a brief breakout. The inability to sustain momentum above this key psychological level suggests a bearish bias may persist. A break below the current support level at 1.2940 would likely signal further downside, reinforcing the bearish sentiment surrounding the pair.

GBP/USD is currently consolidating at between 1.3000 and 1.2930 mark, and a break from either direction shall be a bullish/bearish signal for the pair. The RSI hovers close to the 50 level while the MACD flows between the zero line, giving a neutral signal for the pair.

Resistance level: 1.3045, 1.3125

Support level: 1.2940, 1.2850

The EUR/USD pair has successfully broken its bearish structure and established a higher-high pattern, indicating a potential trend reversal. This bullish shift has been supported by positive eurozone GDP figures, which reflect stronger-than-expected economic growth in the region. However, traders should closely monitor today’s U.S. PCE reading, as it will be crucial in determining the pair’s future direction and may impact the strength of the dollar.

The pair has formed a higher-high pattern and has gotten to its weekly high, suggesting a potential trend reversal for the pair. The RSI has risen to above the 50 level while the MACD has broken above the zero line, suggesting that bullish momentum is forming.

Resistance level:1.0890, 1.0950

Support level: 1.0813, 1.0735

The AUD/USD pair has rebounded from its previous strong bearish momentum, making a notable recovery from recent lows. This uptick is primarily driven by the Australian CPI reading, which exceeded market expectations, potentially influencing the RBA’s forthcoming monetary policy decisions. Additionally, reports of a large-scale economic stimulus package from the Chinese government could further bolster the Australian dollar, given its status as a key trading partner for Australia.

The pair had a technical rebound in the last session but remained trading with excessive bearish momentum. The RSI remains below the 50 level while the MACD remains at the bottom, which aligns with the view.

Resistance level: 0.6610, 0.6670

Support level: 0.6490, 0.6420

The Nasdaq struggled to sustain its upward momentum in the last session, closing approximately 100 points lower. This decline was largely influenced by disappointing earnings reports from both Meta Platforms and Microsoft, which dampened investor sentiment. Looking ahead, the earnings reports from Apple and Amazon, scheduled for release today, are anticipated to significantly affect the Nasdaq’s performance, with traders keenly awaiting their results to gauge market direction.

Nasdaq failed to trade higher after the index broke above the ascending triangle pattern. The RSI is hovering close to the 50 level, but the MACD is edging lower, suggesting the bullish momentum is easing. A break below from 20300 shall be a bearish signal for the index.

Resistance level: 20575.00, 21075.00

Support level: 19705.00, 19120.00

The EUR/JPY surged to its highest level since July, reaching 166.68, indicating a bullish bias for the pair. This movement was propelled by the recent strength of the euro, supported by a higher-than-expected GDP reading. Conversely, the Japanese Yen has faced headwinds due to political uncertainty in Japan. With the Bank of Japan’s (BoJ) interest rate decision scheduled for tomorrow, market participants are advised to closely monitor this development, as it is likely to be a pivotal factor influencing the pair’s future trajectory.

The pair is currently trading with strong bullish momentum and has reached a recent high level, suggesting a bullish signal for the pair. The RSI remained close to the overbought zone while the MACD edged higher, suggesting the pair remain trading with bullish momentum.

Resistance level: 167.10, 169.40

Support level: 165.10, 162.92

Oil prices, despite facing strong bearish momentum, found support near the $67.00 mark and managed a technical rebound in the last session. The uptick was partly driven by upbeat U.S. crude inventory data, indicating steady domestic demand. Additionally, reports suggest that OPEC+ is considering delaying the planned oil production increase in December, citing weak global demand and lower prices as key factors. This potential postponement is providing further support for prices, as market participants interpret the move as a stabilising effort amid prevailing headwinds.

Oil prices recorded a technical rebound but are overwhelmed with the bearish momentum. The RSI sees a rebound from the oversold one while the MACD has a golden cross below; if the oil prices are able to break above the $70.00 mark, it will be seen as a potential trend reversal signal for the oil.

Resistance level: 69.90, 72.50

Support level: 67.10, 65.55

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

Market Summary

The dollar faced pressure from the GDP reading released yesterday, which came in lower than market expectations. However, amidst prevailing risk-off sentiment, the dollar managed to find support above the $104.00 mark. Today’s highly anticipated U.S. PCE reading, the Fed’s preferred inflation gauge, is expected to provide crucial insights into upcoming monetary policy decisions and their implications for the dollar’s strength.

On Wall Street, the Nasdaq was negatively impacted by disappointing earnings from Meta Platforms, alongside a slower earnings forecast for Microsoft’s cloud business. As the tech-heavy index hovers near recent peak levels, traders are closely watching today’s earnings reports from Apple Inc. and Amazon Inc., which are likely to influence the index’s price action.

In the commodity market, gold rose nearly 0.5% in the last session, marking its fifth consecutive gain. The precious metal has attracted demand ahead of the upcoming U.S. election and is expected to continue its upward trend as the election date approaches. Meanwhile, oil prices received a boost from a decrease in U.S. crude inventories reported last night. Additionally, OPEC+ is reportedly delaying its planned full restoration of oil production in December, as the demand outlook for oil remains lackluster.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (4.4%) VS -25 bps (95.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index extended its pullback in the last session but found support just above the 104.00 level, indicating it remains on an uptrend trajectory. The dollar faced pressure from a lower-than-expected GDP reading, which weighed on sentiment. Market participants are now closely watching the U.S. PCE reading due today, which is expected to have a direct impact on the index’s performance. A break below the 104.00 mark could signal a bearish shift for the index, potentially paving the way for further declines if economic data continues to disappoint.

The dollar index’s bullish momentum is easing drastically, with the RSI dropping below the 50 level while the MACD edge is lower than the zero line. A break below the 104.00 mark shall be a bearish signal for the index.

Resistance level: 104.95, 105.55

Support level: 103.95, 103.20

Gold prices surged to a new high, touching the $2,790 mark for the first time, reflecting a bullish bias for the precious metal. The rise was primarily fueled by a softer dollar, weighed down by recent weaker U.S. economic indicators. With the U.S. election just a week away, market participants are seeking safe-haven assets like gold to navigate potential volatility. This election-driven sentiment, alongside existing geopolitical concerns and economic uncertainties, is expected to sustain upward momentum for gold in the near term, possibly pushing prices closer to the $2,800 mark.

Gold prices gained for the 3rd session this week after the gold found support at $2720 levels, suggesting a strong bullish signal for the gold. The RSI remains close to the overbought zone, while the MACD edged higher in the last session, suggesting the bullish momentum remains intact with the gold.

Resistance level: 2795.00, 2810.00

Support level: 2775.00, 2755.00

The GBP/USD pair remains under pressure from recent weak economic indicators and is struggling to hold above the 1.3000 level, despite a brief breakout. The inability to sustain momentum above this key psychological level suggests a bearish bias may persist. A break below the current support level at 1.2940 would likely signal further downside, reinforcing the bearish sentiment surrounding the pair.

GBP/USD is currently consolidating at between 1.3000 and 1.2930 mark, and a break from either direction shall be a bullish/bearish signal for the pair. The RSI hovers close to the 50 level while the MACD flows between the zero line, giving a neutral signal for the pair.

Resistance level: 1.3045, 1.3125

Support level: 1.2940, 1.2850

The EUR/USD pair has successfully broken its bearish structure and established a higher-high pattern, indicating a potential trend reversal. This bullish shift has been supported by positive eurozone GDP figures, which reflect stronger-than-expected economic growth in the region. However, traders should closely monitor today’s U.S. PCE reading, as it will be crucial in determining the pair’s future direction and may impact the strength of the dollar.

The pair has formed a higher-high pattern and has gotten to its weekly high, suggesting a potential trend reversal for the pair. The RSI has risen to above the 50 level while the MACD has broken above the zero line, suggesting that bullish momentum is forming.

Resistance level:1.0890, 1.0950

Support level: 1.0813, 1.0735

The AUD/USD pair has rebounded from its previous strong bearish momentum, making a notable recovery from recent lows. This uptick is primarily driven by the Australian CPI reading, which exceeded market expectations, potentially influencing the RBA’s forthcoming monetary policy decisions. Additionally, reports of a large-scale economic stimulus package from the Chinese government could further bolster the Australian dollar, given its status as a key trading partner for Australia.

The pair had a technical rebound in the last session but remained trading with excessive bearish momentum. The RSI remains below the 50 level while the MACD remains at the bottom, which aligns with the view.

Resistance level: 0.6610, 0.6670

Support level: 0.6490, 0.6420

The Nasdaq struggled to sustain its upward momentum in the last session, closing approximately 100 points lower. This decline was largely influenced by disappointing earnings reports from both Meta Platforms and Microsoft, which dampened investor sentiment. Looking ahead, the earnings reports from Apple and Amazon, scheduled for release today, are anticipated to significantly affect the Nasdaq’s performance, with traders keenly awaiting their results to gauge market direction.

Nasdaq failed to trade higher after the index broke above the ascending triangle pattern. The RSI is hovering close to the 50 level, but the MACD is edging lower, suggesting the bullish momentum is easing. A break below from 20300 shall be a bearish signal for the index.

Resistance level: 20575.00, 21075.00

Support level: 19705.00, 19120.00

The EUR/JPY surged to its highest level since July, reaching 166.68, indicating a bullish bias for the pair. This movement was propelled by the recent strength of the euro, supported by a higher-than-expected GDP reading. Conversely, the Japanese Yen has faced headwinds due to political uncertainty in Japan. With the Bank of Japan’s (BoJ) interest rate decision scheduled for tomorrow, market participants are advised to closely monitor this development, as it is likely to be a pivotal factor influencing the pair’s future trajectory.

The pair is currently trading with strong bullish momentum and has reached a recent high level, suggesting a bullish signal for the pair. The RSI remained close to the overbought zone while the MACD edged higher, suggesting the pair remain trading with bullish momentum.

Resistance level: 167.10, 169.40

Support level: 165.10, 162.92

Oil prices, despite facing strong bearish momentum, found support near the $67.00 mark and managed a technical rebound in the last session. The uptick was partly driven by upbeat U.S. crude inventory data, indicating steady domestic demand. Additionally, reports suggest that OPEC+ is considering delaying the planned oil production increase in December, citing weak global demand and lower prices as key factors. This potential postponement is providing further support for prices, as market participants interpret the move as a stabilising effort amid prevailing headwinds.

Oil prices recorded a technical rebound but are overwhelmed with the bearish momentum. The RSI sees a rebound from the oversold one while the MACD has a golden cross below; if the oil prices are able to break above the $70.00 mark, it will be seen as a potential trend reversal signal for the oil.

Resistance level: 69.90, 72.50

Support level: 67.10, 65.55

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.