-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

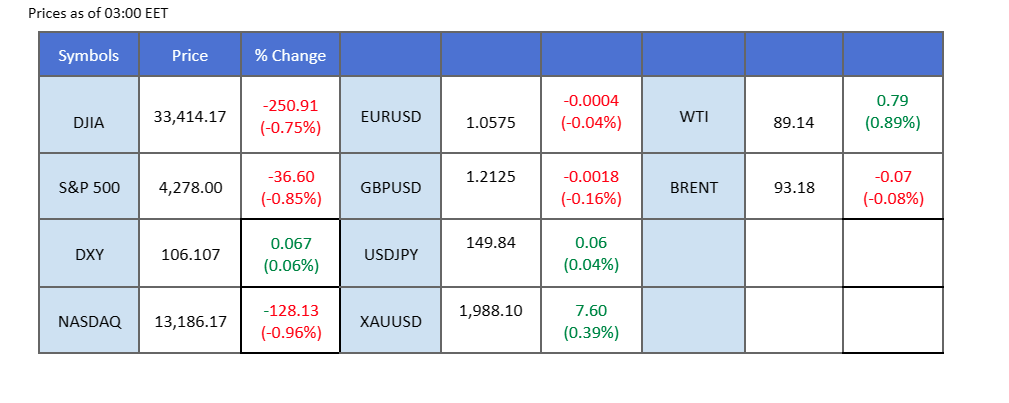

Despite diplomatic efforts by world leaders, including planned visits by the U.S. president and UK’s prime minister to Israel, gold and oil prices continue to surge in response to escalating Middle East tensions. Gold has reached its highest level since July, reflecting heightened global uncertainties. In the financial sphere, Federal Reserve Chairman Jerome Powell’s recent speech aligned with his colleagues, indicating that the bond market has tightened financial conditions, potentially reducing the need for additional Fed rate hikes. This dovish stance led to a plunge in the dollar, as markets perceived that the Fed’s rate had peaked. Attention now turns to the UK’s retail sales data, which will serve as a key indicator of the Sterling’s strength, providing valuable insights into the economic landscape.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.0%) VS 25 bps (12%)

The US Dollar faced a significant decline in response to Federal Reserve Chair Jerome Powell’s dovish statements. While Powell indicated the possibility of future interest rate hikes due to the strength of the US economy, he emphasised that recent bond yield increases, driven by the market, had contributed to tightening overall financial conditions. This narrative questioned the necessity of immediate rate hikes to combat inflation. Following Powell’s comments, market participants revised their expectations for a December rate hike from 39% down to 30%, according to the CME FedWatch Tool. This shift in market sentiment had a noticeable impact on the value of the US Dollar.

The Dollar Index is trading lower following prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 106.60, 107.15

Support level: 105.65, 104.80

Gold prices saw a three-day rally, driven by the weakening US Dollar following Powell’s dovish stance. Simultaneously, rising geopolitical tensions, particularly the potential escalation of conflict in the Middle East, prompted investors to seek the safe-haven appeal of gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 78, suggesting the commodity might enter overbought territory.

Resistance level: 1980.00, 2002.00

Support level: 1960.00, 1945.00

The Euro saw a modest technical rebound as the dollar weakened following Federal Reserve Chairman Jerome Powell’s speech. Echoing his colleagues, Powell’s remarks highlighted elevated U.S. Treasury yields, tightening the country’s financial conditions. This dovish stance curtailed the dollar’s strength, leading to a decline in its value. The Euro capitalised on this weakened dollar, experiencing a slight upward movement in the market.

EUR/USD rebounded yesterday but was suppressed by its strong psychological resistance level at 1.0600. The RSI and the MACD have been hovering flat, giving a neutral signal for the pair.

Resistance level: 1.0630, 1.0700

Support level: 1.0500, 1.0460

The U.S. dollar faced a decline, enabling the Australian dollar to strengthen and form a notable triple bottom price pattern. This movement was fueled by growing market consensus that the Federal Reserve has reached its peak rate, a sentiment reinforced by several Fed officials and confirmed by Chairman Powell’s recent statement. Attention now shifts to Australia’s upcoming CPI data, anticipated to offer insights into the Reserve Bank of Australia’s monetary policy direction. Investors are closely monitoring these developments for strategic positioning.

The AUD/USD pair has formed a triple bottom price pattern suggesting a bullish trend next but a lower high price pattern has contradict with the bullish view. The RSI has been flowing below the 50-level and the MACD has kept below the zero line suggesting the bearish momentum is still intact with the pair.

Resistance level: 0.6400, 0.6510

Support level: 0.6290, 0.6200

The US equity market experienced a relatively flat day, with investors navigating mixed sentiments. Powell’s dovish stance, coupled with a surge in 10-year Treasury yields, contributed to market uncertainty. Meanwhile, rising geopolitical tensions acted as a risk-off catalyst, diminishing the allure of riskier equities. On the other hand, Netflix recorded a remarkable 16% surge after surpassing analyst expectations in its Q3 results, marking substantial subscriber growth. Tesla faced a 9% decline as its Q3 reports failed to meet market expectations, highlighting the market’s selective response to corporate earnings.

The Dow is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 33895.00, 34355.00

Support level: 33370.00, 32840.00

Despite the UK’s high inflation rate compared to its G7 counterparts, GBP/USD faces prolonged declines, reflecting broader market apprehension and waning risk appetite driven by ongoing concerns over potential Iranian involvement in the Israel-Palestine conflict. As the Pound Sterling grapples with heightened risk aversion, investors will closely monitor the forthcoming release of UK Retail Sales data on Friday for additional market insights,

GBP/USD is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.2220, 1.2295

Support level: 1.2125, 1.2045

Cheaper dollar valuation made dollar-denominated oil more expensive, leading to an increase in oil prices. Additionally, concerns over the Israel-Gaza conflict escalating to a regional conflict added to market jitters, further driving up oil prices.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 60, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 89.35, 94.00

Support level: 86.40, 82.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!

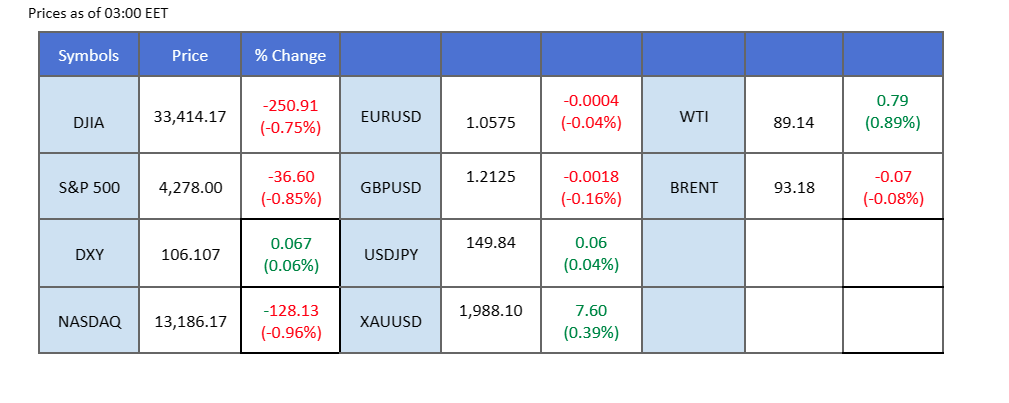

Despite diplomatic efforts by world leaders, including planned visits by the U.S. president and UK’s prime minister to Israel, gold and oil prices continue to surge in response to escalating Middle East tensions. Gold has reached its highest level since July, reflecting heightened global uncertainties. In the financial sphere, Federal Reserve Chairman Jerome Powell’s recent speech aligned with his colleagues, indicating that the bond market has tightened financial conditions, potentially reducing the need for additional Fed rate hikes. This dovish stance led to a plunge in the dollar, as markets perceived that the Fed’s rate had peaked. Attention now turns to the UK’s retail sales data, which will serve as a key indicator of the Sterling’s strength, providing valuable insights into the economic landscape.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.0%) VS 25 bps (12%)

The US Dollar faced a significant decline in response to Federal Reserve Chair Jerome Powell’s dovish statements. While Powell indicated the possibility of future interest rate hikes due to the strength of the US economy, he emphasised that recent bond yield increases, driven by the market, had contributed to tightening overall financial conditions. This narrative questioned the necessity of immediate rate hikes to combat inflation. Following Powell’s comments, market participants revised their expectations for a December rate hike from 39% down to 30%, according to the CME FedWatch Tool. This shift in market sentiment had a noticeable impact on the value of the US Dollar.

The Dollar Index is trading lower following prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 106.60, 107.15

Support level: 105.65, 104.80

Gold prices saw a three-day rally, driven by the weakening US Dollar following Powell’s dovish stance. Simultaneously, rising geopolitical tensions, particularly the potential escalation of conflict in the Middle East, prompted investors to seek the safe-haven appeal of gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 78, suggesting the commodity might enter overbought territory.

Resistance level: 1980.00, 2002.00

Support level: 1960.00, 1945.00

The Euro saw a modest technical rebound as the dollar weakened following Federal Reserve Chairman Jerome Powell’s speech. Echoing his colleagues, Powell’s remarks highlighted elevated U.S. Treasury yields, tightening the country’s financial conditions. This dovish stance curtailed the dollar’s strength, leading to a decline in its value. The Euro capitalised on this weakened dollar, experiencing a slight upward movement in the market.

EUR/USD rebounded yesterday but was suppressed by its strong psychological resistance level at 1.0600. The RSI and the MACD have been hovering flat, giving a neutral signal for the pair.

Resistance level: 1.0630, 1.0700

Support level: 1.0500, 1.0460

The U.S. dollar faced a decline, enabling the Australian dollar to strengthen and form a notable triple bottom price pattern. This movement was fueled by growing market consensus that the Federal Reserve has reached its peak rate, a sentiment reinforced by several Fed officials and confirmed by Chairman Powell’s recent statement. Attention now shifts to Australia’s upcoming CPI data, anticipated to offer insights into the Reserve Bank of Australia’s monetary policy direction. Investors are closely monitoring these developments for strategic positioning.

The AUD/USD pair has formed a triple bottom price pattern suggesting a bullish trend next but a lower high price pattern has contradict with the bullish view. The RSI has been flowing below the 50-level and the MACD has kept below the zero line suggesting the bearish momentum is still intact with the pair.

Resistance level: 0.6400, 0.6510

Support level: 0.6290, 0.6200

The US equity market experienced a relatively flat day, with investors navigating mixed sentiments. Powell’s dovish stance, coupled with a surge in 10-year Treasury yields, contributed to market uncertainty. Meanwhile, rising geopolitical tensions acted as a risk-off catalyst, diminishing the allure of riskier equities. On the other hand, Netflix recorded a remarkable 16% surge after surpassing analyst expectations in its Q3 results, marking substantial subscriber growth. Tesla faced a 9% decline as its Q3 reports failed to meet market expectations, highlighting the market’s selective response to corporate earnings.

The Dow is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 33895.00, 34355.00

Support level: 33370.00, 32840.00

Despite the UK’s high inflation rate compared to its G7 counterparts, GBP/USD faces prolonged declines, reflecting broader market apprehension and waning risk appetite driven by ongoing concerns over potential Iranian involvement in the Israel-Palestine conflict. As the Pound Sterling grapples with heightened risk aversion, investors will closely monitor the forthcoming release of UK Retail Sales data on Friday for additional market insights,

GBP/USD is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1.2220, 1.2295

Support level: 1.2125, 1.2045

Cheaper dollar valuation made dollar-denominated oil more expensive, leading to an increase in oil prices. Additionally, concerns over the Israel-Gaza conflict escalating to a regional conflict added to market jitters, further driving up oil prices.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 60, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 89.35, 94.00

Support level: 86.40, 82.50

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.